Directors’ role on company boards has become more complex and demanding, especially for independent directors. Increasingly they have to monitor and manage diverse stakeholders’ interest, instead of being primarily focused on protecting shareholders‘ interests and expectations. With regard to banks, this was borne out when an independent director of Indusind Bank sought reappointment from shareholders. The reappointment, which had the support of the founders/promoters and the executive management, required the approval of 75% of voting shareholders.

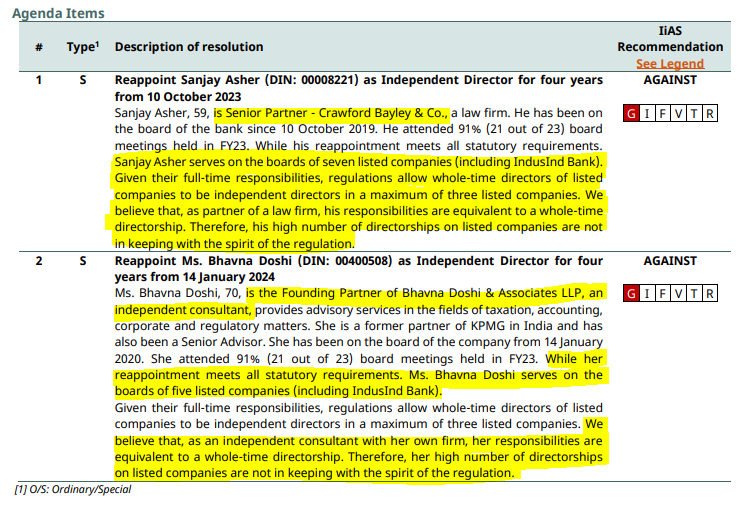

On October 5, 2023, Indusind Bank shareholders rejected the re-appointment of Sanjay Asher, senior partner of the prestigious law firm Crawford Bayley and Company, as independent director. This development should send alarm bells ringing in India’s corporate world. What is noteworthy is that the shareholders’ rejection was not on the ground of any lack of competence on Asher’s part, but because the proxy advisory firms recommended his rejection. The proxy firms did so on the ground that, since Asher was a partner in a law firm, he was equivalent to a wholetime (executive) director there.

As per Securities and Exchange Board of India (SEBI) regulations, a wholetime director can be an independent director in a maximum of three listed companies. SEBI regulations further allow that independent directors have a maximum of seven directorships. Asher was on seven boards as an independent director. Hence not only was he conforming to SEBI regulations for independent directors, but he was also considered ‘fit and proper’ as per Reserve Bank of India (RBI) norms for directors.

Institutional Investor Advisory’s Services (IiAS) Recommendations on Indusind Bank’s Resolutions

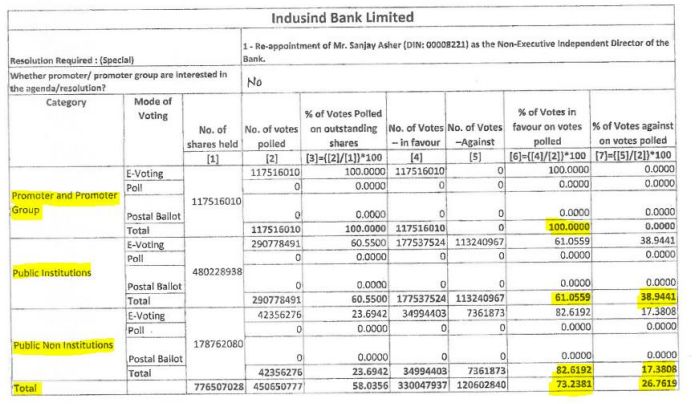

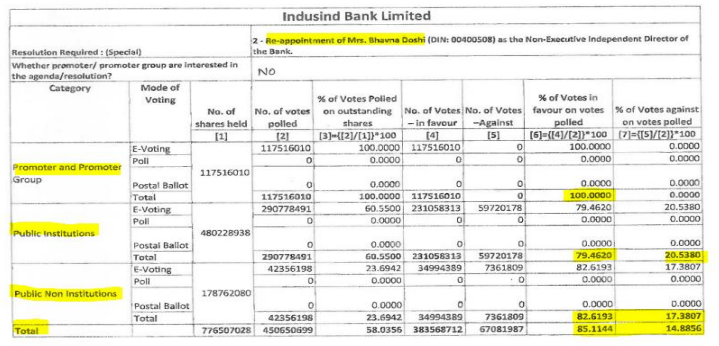

Votes Polled by Indusind Bank’s Shareholders on the Resolutions

Interestingly, while Asher narrowly failed to get the required majority, as 26.8% of the shareholders rejected his reappointment, another independent director, whose reappointment the advisory firms had recommended against on similar grounds, was reappointed with 85.1% of the shareholders voting in her favour.

There are lessons which need to be urgently learnt by corporate boards from this episode. Merely adhering to the prevalent regulations is insufficient to save the board from a major public embarrassment. In the case of Indusind Bank, the board of directors, in recommending the continuance of both independent directors, conformed to all the regulations, but unfortunately the advisory firms were of the view that independent directors who are partners in professional firms should have a maximum of three directorships, and not seven, as mandated by the capital markets regulator.

Corporate boards now have to take such views into consideration in decision-making, as proxy advisory firms wield considerable influence, and can overturn decisions, especially in cases which require the passing of a special resolution with a 75% majority. On account of the considerable influence proxy advisory firms have over institutional investors, boards cannot afford to ignore their views in such cases.

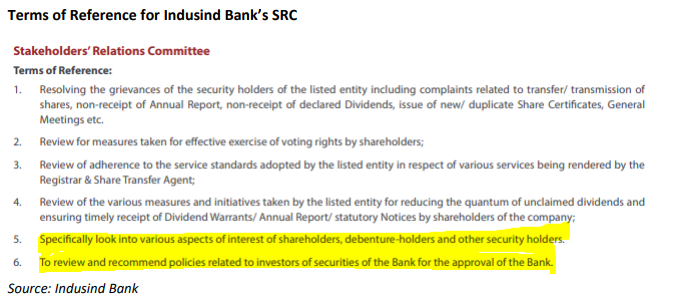

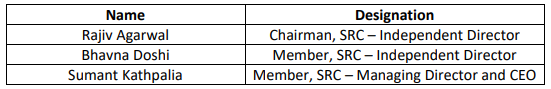

Indusind Bank’s Stakeholders Relationship Committee as on March 31, 2023

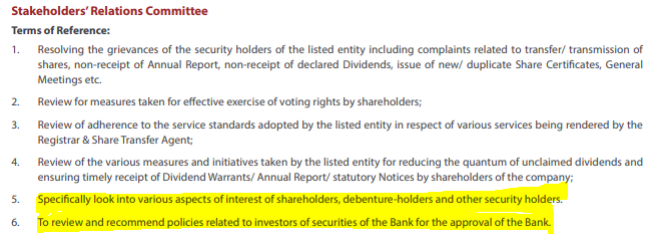

Typically, the Stakeholders Relationship Committee (SRC) of the board of directors has the task of considering stakeholders’ concerns and interests, but they have normally confined themselves to shareholder grievances and the terms of reference are restricted to only shareholders and security holders.

As the name given to the committee concerns stakeholders, they have to broaden their role to also include depositors, employees, regulators, proxy advisory firms and analysts. As banks play a critical role in the economy, the role of the SRC has to be strengthened, and members have to take a more active interest in its workings. The broadening of the SRC’s responsibilities will enhance its importance within the board and the company.

In private sector banks, the SRCs have failed to protect the interests of employees, as is seen by the high attrition of 31% to 51% in some of the banks in FY2023. This has made the RBI publicly express concern in this regard. The SRCs need to be activated, and have to take cognizance of material information that is brought to their knowledge, including non-public information.

By engaging and being receptive to stakeholders, the SRCs can be forward-looking. To operate successfully, the SRCs would need to be more proactive and engage with employee representatives (which is difficult in many private sector banks in the absence of staff unions and officer associations), proxy advisory firms and even analysts covering the concerned companies to get insights which the board may not be getting from the management.

The rejection by Indusind Bank shareholders of the renewal of the term of an independent director, despite it being supported by the founder and the board, is a major embarrassment. Even though the renewal complied with regulatory norms, the rejection highlights the board’s lack of concern for current governance norms, and the failure of the bank’s SRC in briefing the board regarding the concerns of proxy advisory firms. Company boards have an organisational structure, in the form of the SRC, to address these issues, but this structure needs to be activated in order to improve governance in companies.

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). Please see SEBI disclosure here. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. I own equity shares in Indusind Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

www.hemindrahazari.com

All rights reserved. No portion of this article may be reproduced in any form without permission from the author. For permissions contact: