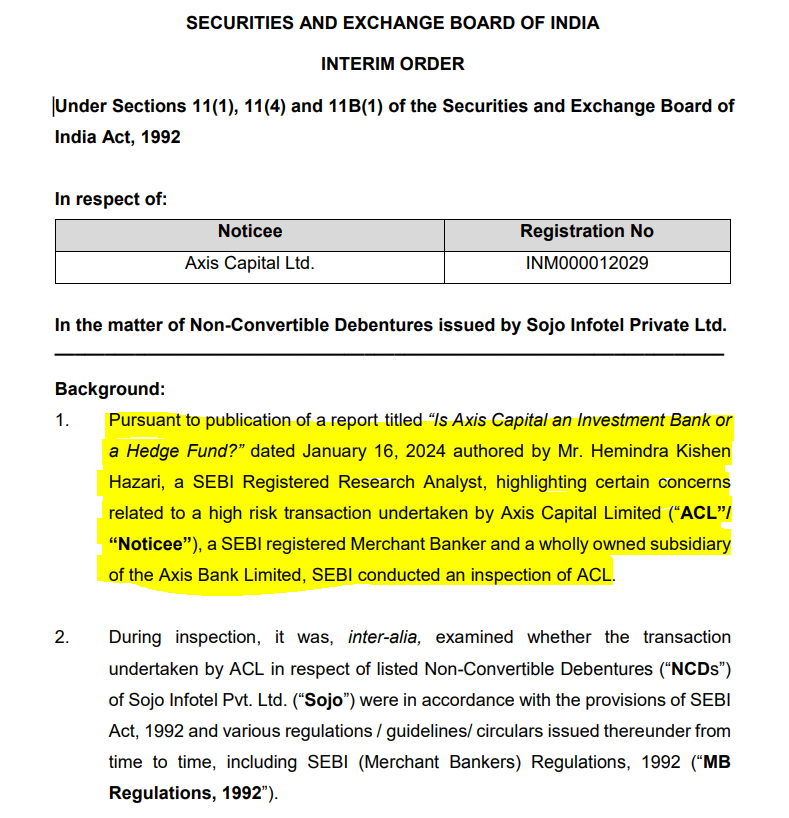

India’s capital markets regulator, the Securities and Exchange Board of India (SEBI), on September 19, 2024 passed an interim order on Axis Capital (a 100% subsidiary of Axis Bank), barring the merchant bank from undertaking any debt transactions. An unusual feature in this order was the citing of this analyst’s research report titled, Is Axis Capital an Investment Bank or a Hedge Fund, dated January 16, 2024 as the basis for the regulator launching an investigation. It is highly unusual for a regulator in any jurisdiction to publicly cite an independent research report to justify conducting and taking action on a regulated entity.

Extract of SEBI Oder on Axis Capital Dated September 19, 2024

Source: SEBI

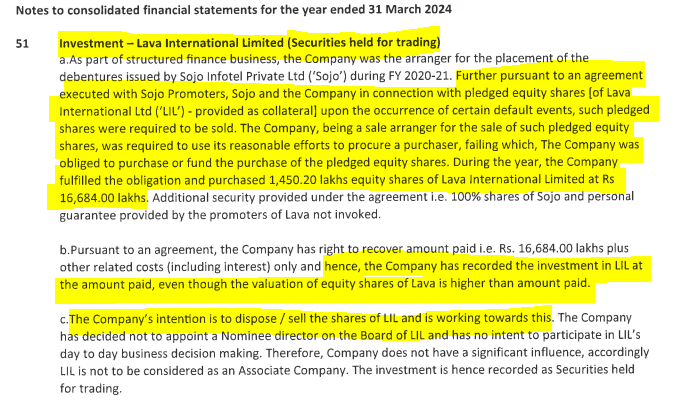

This analyst had highlighted the fact that Axis Capital had not only engaged in a transaction with abysmally poor credit appraisal and risk management, but it had also underwritten the interest and principal of Sojo Infotel’s bond issue, effectively exposing the parent bank’s capital at risk. As security for providing the “underwriting commitment”, the Sojo Infotel promoters pledged 26.8% of their holdings in Lava International, an unlisted company, as security to Axis Capital. On the maturity date of the bond, Sojo Infotel defaulted, and Axis Capital had to make good on its “underwriting commitment” by paying Rs 1.67 bn (12.4% of Axis Capital’s FY2024 net worth) to the bond holders on March 19, 2024. SEBI’s contention in the order was that merchant banks are prohibited from guaranteeing interest and principal repayments of a bond, as that activity is conducted by banks regulated by the Reserve Bank of India (RBI). SEBI’s assertion is that Axis Capital disguised a guarantee as “underwriting commitment” in the Sojo Infotel non-convertible bond issue.

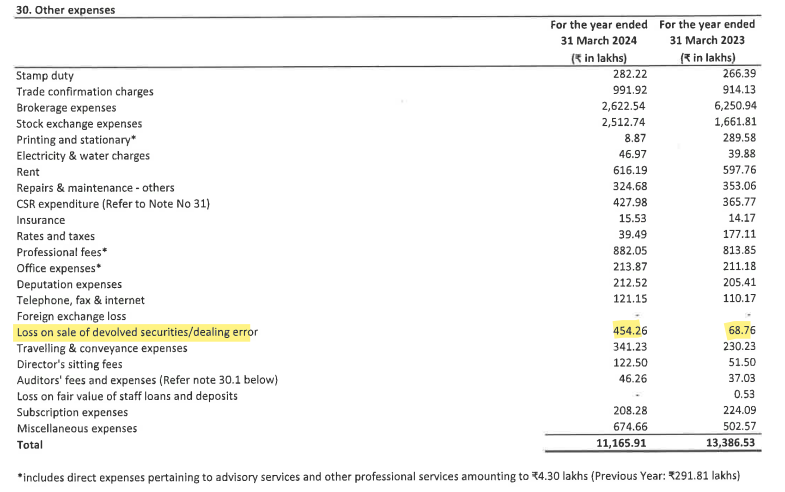

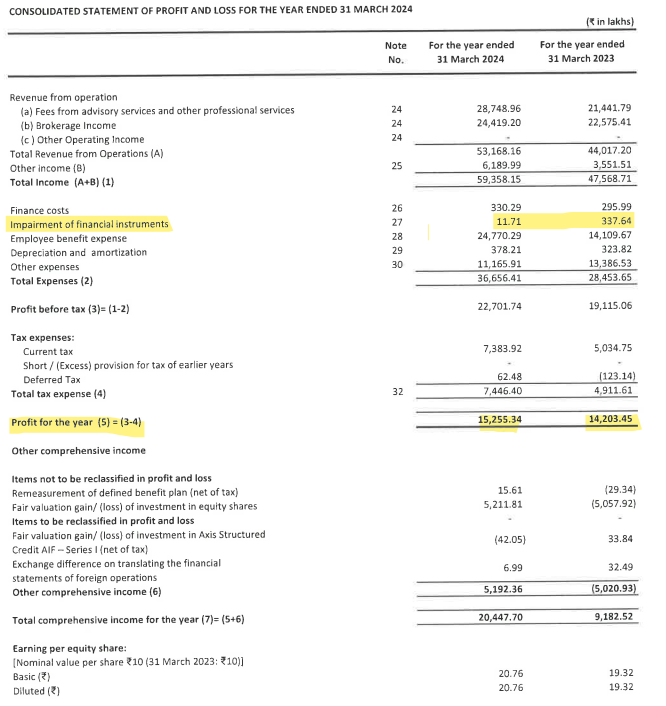

Interestingly, once Axis Capital made the payment of Rs 1.67 bn to the bond holders, it should have charged the same to its FY2024 income and profits. An analysis of Axis Capital’s FY2024 consolidated results reveals that there were no significant provisions or impairment of its investment in Lava International. The loss on sale of devolved securities/dealing error was only Rs 45.43 mn in FY2024 (Rs 6.9 mn in FY2023) and total impairment of financial instruments in FY2024 was only Rs 1.1 mn, (Rs 33.8 mn in FY2023). Indeed, in FY2024 Axis Capital reported higher net profits of Rs 1.5 bn, as against Rs 1.4 bn in FY2023. When, in reality, if Axis Capital had provided fully for the “underwriting commitment”, the company would have had to report a loss.

Source: Axis Capital FY2024 Annual Report p. 149

Source: Axis Capital FY2024 Annual Report p. 118

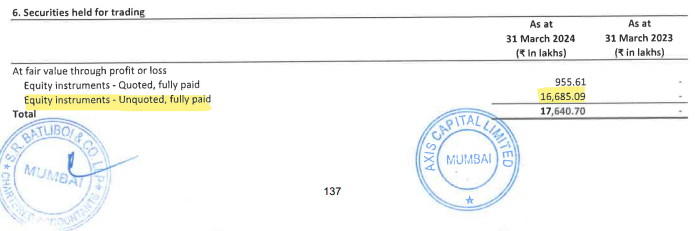

Instead, Axis Capital strangely reported its 26.8% equity investment in unlisted illiquid Lava International as “Securities Held for Trading” on the grounds that it is being held with the intention of selling the shares, and the company is working towards achieving that goal.

Extracts from Axis Capital’s FY2024 Annual Report

Source: Axis Capital FY2024 Annual Report p. 137

Source: Axis Capital FY2024 Annual Report p. 176

In response to a query from this analyst on Axis Capital’s classification of its Lava International equity shares, Axis Bank stated,

Financial instrument is classified as held for trading if it is acquired or incurred principally for selling.

Given the fact pattern, the investment is consequently classified as “Securities held for trading.”

It is highly unusual for a company to classify an unlisted, illiquid share as “held-for-trading”, as this category implies that the financial instruments are liquid and that there are daily buy and sell quotes for buyers and sellers. The “fact pattern” by Axis Capital’s own acknowledgement, reveals the Lava International equity shares devolved onto the company because it was unable to find a buyer for the 26.8% holding in the company.

The company [Axis Capital], being a sole arranger for the sale of such pledged equity shares, was required to use its reasonable efforts to procure a purchaser, failing which [bold ours], The Company was obliged to purchase or fund the purchase of the pledged equity shares. (Axis Capital FY2024 annual report p. 176)

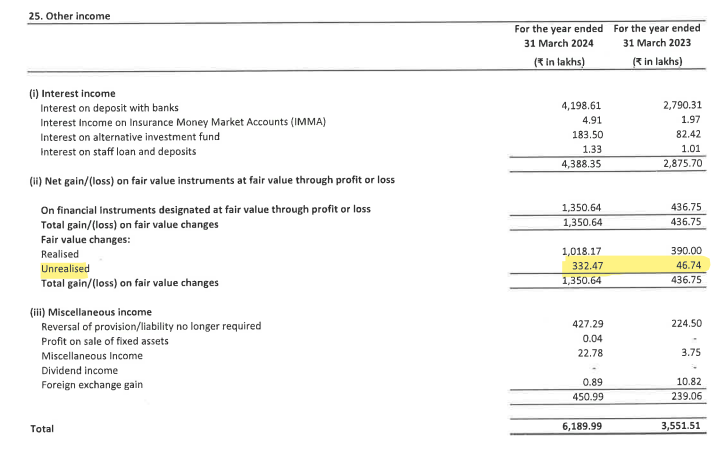

There appears to be little clarity when Axis Capital states that the valuation of Lava International shares is higher than the amount the company paid for it, as there is no disclosure on who did the valuation report, and what were the assumptions and the exact value ascribed to Lava International by the anonymous valuation consultant. There is even a possibility that Axis Capital has booked unrealised gains on its Lava International equity shares, as the company admits that the valuation is higher than its holding cost. In FY2024 Axis Capital reported Rs 33.2 mn as unrealised gains as compared with Rs 4.7 mn in FY2023.

Consolidated Other Income of Axis Capital

Source: Axis Capital FY2024 Annual Report p. 147

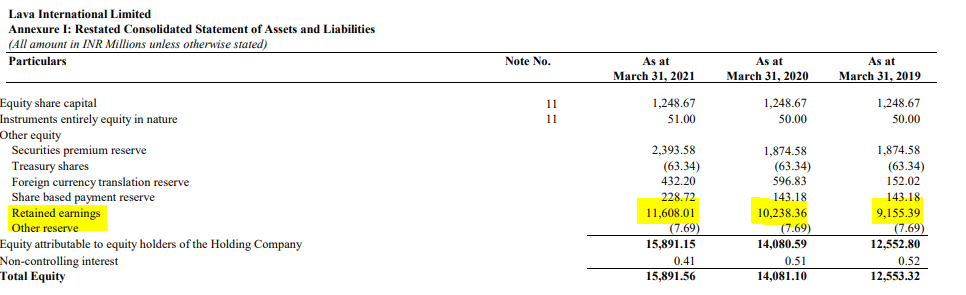

The holding cost of its Lava International shares for Axis Capital is Rs 11.5 per share. In Lava International’s DRHP dated September 27, 2021, FY2021 was the last year of financial accounts that were disclosed. In FY2021 Lava International disclosed a book value of Rs 125. In the period from FY2019 till FY2021 retained earnings of the company kept increasing. In FY2022 as a result of an equity issue the book value declined to Rs 37, even as retained earnings increased.

Source: Lava International Draft Red Herring Prospectus, September 29, 2021. p. 246

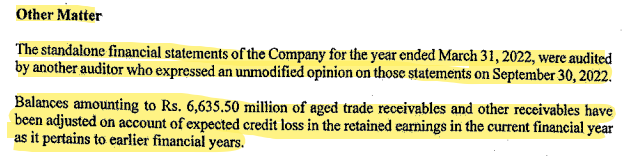

However, the situation for Lava International changed dramatically from FY2023. On March 4, 2024, India Ratings downgraded Lava International Debt rating to ‘IND BBB+’ and placed it on rating watch with negative implications for delay in finalising its FY2023 audited results. Subsequently, standalone FY2023 accounts were finalised on March 26, 2024, while consolidated accounts for FY2023 were finalised on May 20, 2024.

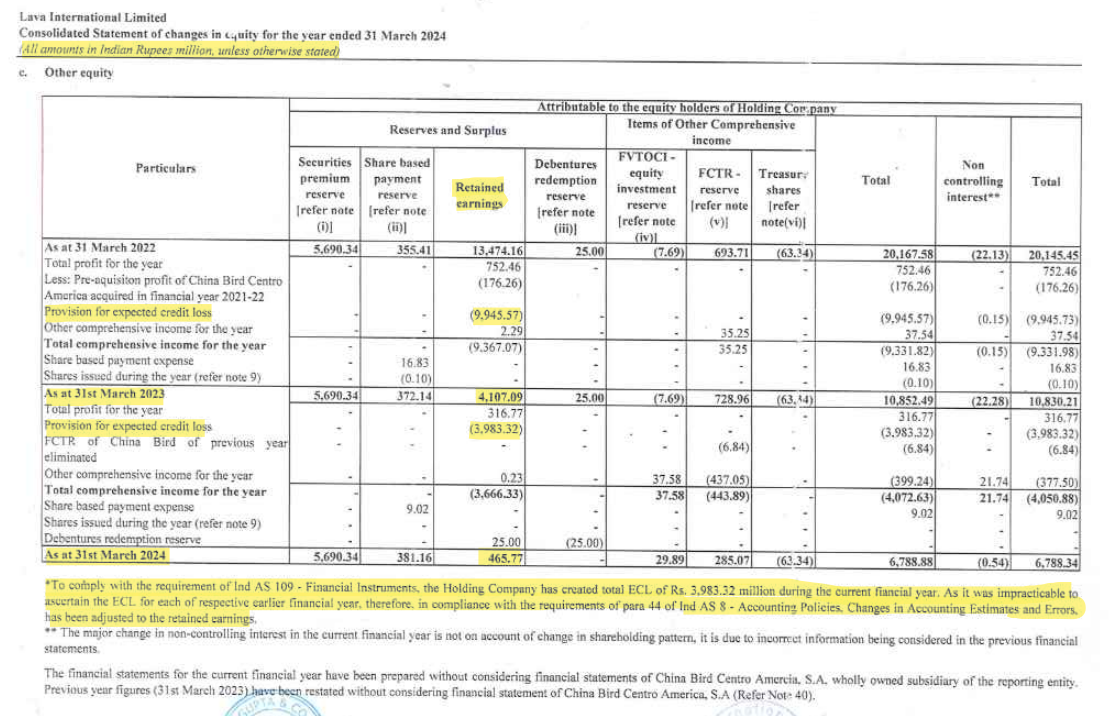

In Lava International’s FY2023 audit report, the public became aware that the prior years’ accounts of Lava International were not credible. In FY2023 the company took a provision for expected credit loss (ECL) of Rs 10 bn and in FY2024 a further ECL of Rs 4 bn. Both these charges were taken directly against retained earnings as per Ind AS 109 and para 44 of Ind AS 8 pertaining to errors in accounting.

Extract from Lava International’s FY2023 Auditor’s Report

Source: Lava International FY2023 Annual Report p. 30

Source: Lava International FY2024 Annual Report p. 135

As a result of these charges Lava International’s consolidated book value declined to Rs 24.5 in FY2023 and to Rs 17 in FY2024.

Lava International Consolidated Book Value

| Rs mn | FY2021 | FY2022 | FY2023 | FY2024 |

| Equity | 1,249 | 2,706 | 2,706 | 2,706 |

| Reserves | 14,664 | 20,201 | 10,885 | 6,822 |

| Intangibles | -30 | -2,220 | -22 | -11 |

| Goodwill | 0 | -427 | 0 | 0 |

| DTA | -229 | -316 | -310 | -364 |

| Net worth | 15,654 | 19,945 | 13,259 | 9,153 |

| No. of equity shares (m) | 124.9 | 541.126 | 541.126 | 541.126 |

| BV (Rs) | 125.3 | 36.9 | 24.5 | 16.9 |

Source: Lava International

Lava International’s ECL for earlier years raise some major concerns. Firstly, it was a failure of the lead managers (Axis Capital, BOB Capital Markets, DAM Capital Advisors and SBI Capital Markets) of the Lava International proposed Initial Public Offering (IPO), which was subsequently cancelled, to have conducted a thorough due diligence of the historic financial accounts of the company. If the IPO had succeeded, the new public investors would have been laden with these losses. Secondly, as Lava International has reported two consecutive years of hefty ECL provisions against retained earnings, prospective investors are uncertain whether there are more hidden losses to emerge in the future.

There also is the major issue that after FY2022, Lava International’s revenue is declining, as are the company’s EBITDA, EBITDA margin and net profits. The only positive is that cash flow net of interest improved in FY2024.

Consolidated Lava International Sales, EBITDA and Cash Flow

| Rs mn | FY2019 | FY2020 | FY2021 | FY2022 | FY2023 | FY2024 |

| Revenue | 51,084 | 52,643 | 55,128 | 58,776 | 49,026 | 36,461 |

| EBITDA | 1,262 | 1,707 | 2,665 | 3,392 | 2,513 | 1,030 |

| EBITDA Margin (%) | 2.5 | 3.2 | 4.8 | 5.8 | 5.1 | 2.8 |

| Net Profit | 732 | 1,078 | 1,726 | 1,869 | 752 | 339 |

| Cash Flow from Operating Activities | -2,781 | -1,327 | 1,518 | 553 | -31 | 1,130 |

| Interest Received | 279 | 99 | 100 | 40 | 49 | 124 |

| Interest paid on lease liability | 0 | -27 | -25 | -21 | -19 | -16 |

| Interest paid on borrowings | -206 | -131 | -248 | -258 | -217 | -202 |

| Cash Flow Net of Interest | -2,708 | -1,386 | 1,345 | 314 | -217 | 1,035 |

Source: Lava International

Therefore, while Axis Capital intends to sell its shares in Lava International, getting prospective buyers could be extremely difficult. Hence the company’s claim of the valuation being more than its holding cost may not be reliable.

Stakeholders, including Axis Bank shareholders, SEBI and the RBI have to carefully examine the dual role of Axis Bank representatives on Axis Capital’s board of directors, and the role of the merchant bank’s audit committee. As this analyst’s earlier note had highlighted, the Axis Capital board had endorsed the underwriting of the Sojo Infotel’s Rs 2.6 bn non-convertible bond issue, and approved an effective guarantee exposing 50% of its own capital at that time in FY2021. It is this “underwriting commitment” that has made SEBI investigate Axis Capital and ordered the company in an interim order to cease doing any debt transactions. The regulator ceasing an important line of business for a regulated entity is a very serious offence, and the Axis Capital board of directors, including its independent directors, need to be held accountable for approving a high-risk transaction which SEBI found to be illegal.

Axis Capital Board of Directors and Audit Committee in FY2021 and FY2024

| FY2021 | FY2024 | |

| Amitabh Chaudhry | Non-executive Chairman | |

| Atul Mehra | – | Managing Director (MD) & CEO |

| Neelkanth Mishra | – | Executive Director |

| Ganesh Sankaran | – | Non-Executive Director (member Audit Committee) |

| Bahram Navroze Vakil | Independent Director (member Audit Committee) | |

| Samirkumar Barua | Independent Director (member Audit Committee) | |

| Sutapa Banerjee | Independent Director (member Audit Committee) | |

| Salil Pitale | Jt MD & Co-CEO | – |

| Chirag Negandhi | Jt MD & Co-CEO | – |

| Rajiv Anand | Non-executive Director | – |

Source: Axis Capital

The manner in which Axis Capital has subsequently accounted for its investment in Lava International and classified an unlisted, illiquid (for which, by its own admission, it could not find buyers) as “Held-for-Trading” needs to be also investigated by both regulators. In banks, once a guarantee devolves, it is immediately classified as non-performing, and full provisions are made. By classifying the investment as “Held-for-Trading”, and stating that the valuation is higher than the company’s holding cost, Axis Capital has apparently not made the required provisions and hence its own profit and loss for FY2024 may not be a true and fair account.

The size of the transaction in FY2021, and the fact it was around 50% of Axis Capital’s net worth at that time, would have required board approval, and hence no board member can claim that they were unaware of the transaction. Prudent credit appraisal and risk management should have not permitted such a transaction, worse once the underwriting commitment devolved appropriate provisions should have been made. As Axis Capital is a 100% subsidiary of Axis Bank, the accounts of the subsidiary are consolidated with the bank. Hence in FY2024, the Axis Bank’s consolidated accounts may not be providing a true and fair view if the provisions for Lava International have not been factored in Axis Bank’s consolidated accounts.

In both FY2021, when the board of Axis Capital approved the high-risk transaction, and in FY2024 when apparently the required provisions have not been made, the role of Amitabh Chaudhry, CEO Axis Bank and non-executive chairman of Axis Capital needs to be examined by both SEBI and the RBI. While the Axis Bank board of directors has approved another term for Amitabh Chaudhry as CEO on April 25, 2024, for a 3-year period beginning January 1, 2025, the RBI has to date not approved the appointment. On September 11, 2024, the Mint newspaper reported that the RBI had found numerous violations pertaining to providing incentives to bank staff for raising deposits.

SEBI’s interim order, which severely penalised Axis Capital, also made a specific request to RBI to examine Axis Capital’s conduct, as the deal exposed the bank’s capital to risk. The possibility of Axis Capital and Axis Bank’s results not revealing a true and fair view on account of the high-risk transaction and SEBI’s interim order on Axis Capital puts the RBI’s approval of Chaudhry at risk. Recently, the regulators have taken stringent action against regulated entities for various violations. Axis Bank shareholders need to consider the issue of leadership continuity at Axis Bank, as the violations documented by SEBI and the accounting of the Lava International investment in Axis Capital’s accounts are serious, and when such violations becomes public it is difficult for the regulator to reward the existing leadership by approving another term for the CEO.

__________________________________________________

DISCLOSURE

I, Hemindra Kishen Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594), BSE Enlistment No. 5036. Please see SEBI disclosure here. Investment in securities market are subject to market risks. Read all the related documents before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendary. I own equity shares in Axis Bank. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.

www.hemindrahazari.com

All rights reserved. No portion of this article may be reproduced in any form without permission from the author. For permissions contact: