EXECUTIVE SUMMARY. Two long serving senior executives of HDFC Bank who headed important business verticals have abruptly quit the bank, reportedly under unusual circumstances....

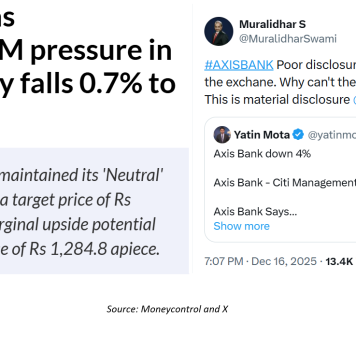

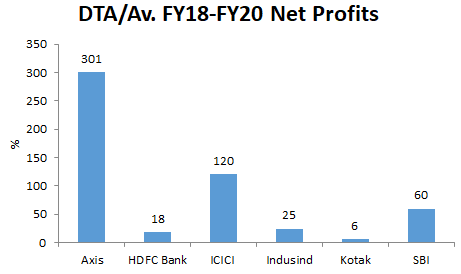

EXECUTIVE SUMMARY. At a time when many private sector banks such as HDFC Bank, ICICI Bank, Axis Bank, Indusind Bank and Yes Bank have...

EXECUTIVE SUMMARY. To address the woeful state of corporate governance in India’s banking sector, especially in the much fancied and widely covered private sector...

In Ian Fleming’s iconic James Bond movie franchise, the dapper 007 manages to get away, however precarious the situation. Similarly, in Yes Bank, one...

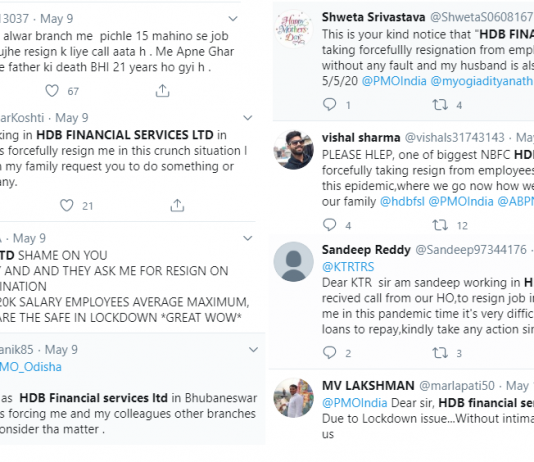

EXECUTIVE SUMMARY. HDFC Bank, India’s largest bank by market capitalisation appears to be the first off the block in demanding resignations from permanent staff...

Axis-2009-to-2018-Case-Study-in-Mismanagement-and-Board-FailureDownload

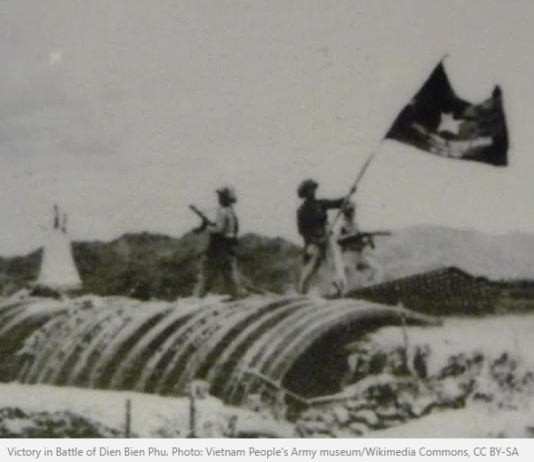

Vietnamese ingenuity, in leveraging popular support to liberate their country and abandoning conventional military doctrines, paved the way for a historic victory over French colonialism.

08/MAY/2020

On...

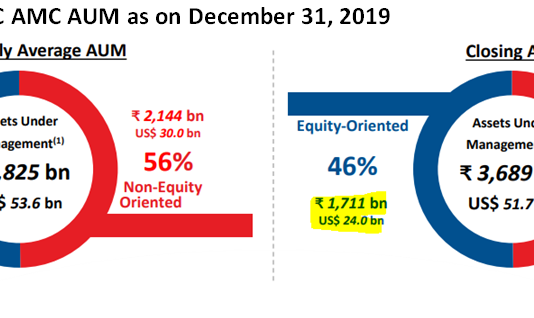

EXECUTIVE SUMMARY. In the quarter ended March 31, 2020 HDFC AMC was dethroned as the market leader by SBI Mutual Fund, based on quarterly...

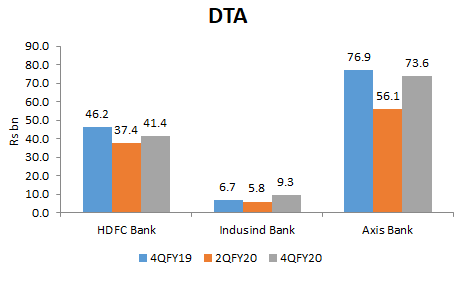

EXECUTIVE SUMMARY. In the case of all the three prominent private sector banks (HDFC Bank, Indusind Bank and Axis Bank) that have declared 4QFY2020...

The author acknowledges the contribution of Aspects of India’s Economy (RUPE) for this article

EXECUTIVE SUMMARY. There was a sharp rise in corporate India’s external...