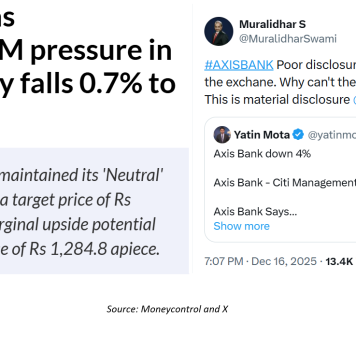

EXECUTIVE SUMMARY. At a time when the economic environment is very volatile, and HDFC Bank’s share price has seen an unexpected slump, comes news...

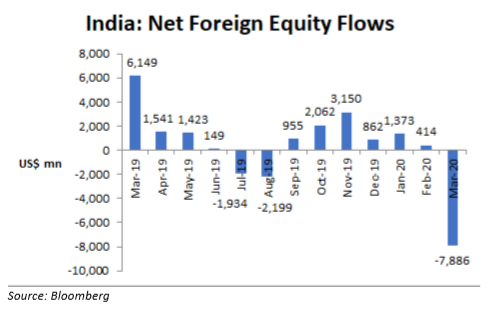

EXECUTIVE SUMMARY. The sharp fall in index heavyweights as a result of foreign equity outflows resulted in panic amongst investors. Prominent sell-side firms arranged...

EXECUTIVE SUMMARY. April 1, 2020, All Fools Day, the first day of FY2021, was an eventful day for Kotak Mahindra Bank (KMB) shareholders, as...

Indusind-Bank-Fiasco-and-the-Sleeping-Sentinels-1Download

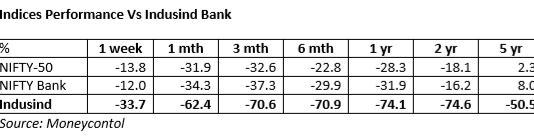

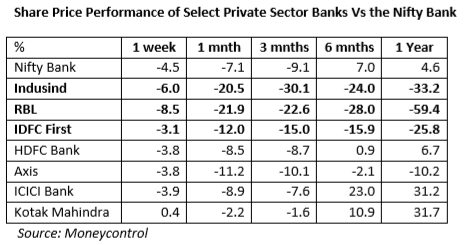

EXECUTIVE SUMMARY. The savage mauling of Indusind Bank’s share price in the last year, and especially in the last month, is a reflection of...

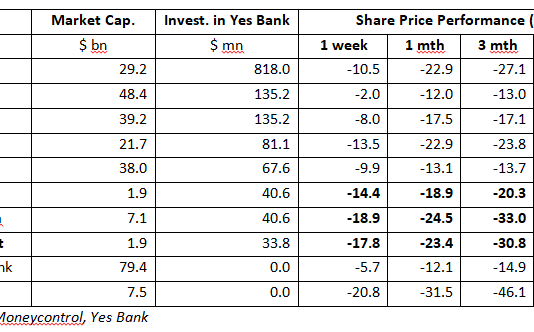

EXECUTIVE SUMMARY. In the SBI-led bail-out of Yes Bank assisted by private sector entities, HDFC Bank, the largest private sector bank, is notably absent,...

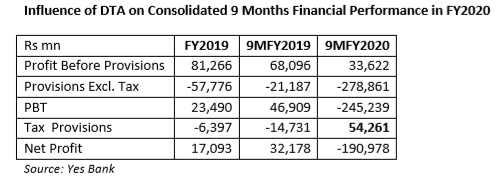

EXECUTIVE SUMMARY. Yes Bank reported a staggering consolidated net loss of Rs 191 bn ($2.6 bn) for the 9 month period ended December 31,...

In light of the moratorium on Yes Bank on March 6, 2020, Smartkarma compiled my research notes from May 15, 2017 where I had...

EXECUTIVE SUMMARY. The Reserve Bank of India’s (RBI) draft scheme for the reconstruction of Yes Bank is unlikely to restore the confidence of the...

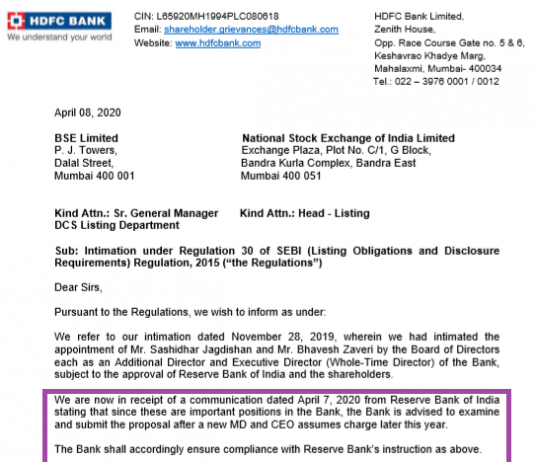

The central bank's decision to not spell out a rationale does little in terms of adding to the ownership debate.

Hemindra Hazari BANKING...