The language used in the writ petition filed by Kotak Mahindra Bank (KMB) in Bombay High Court against the banking regulator should have alarmed...

EXECUTIVE SUMMARY

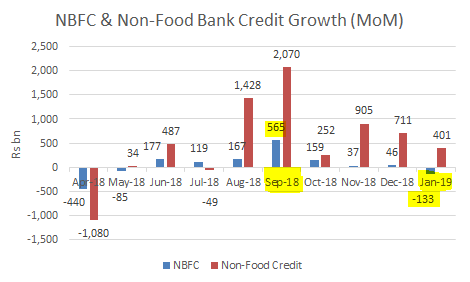

For the beleaguered non-bank finance company (NBFC) sector, banks are the single largest component of external funding. This source peaked at the end...

EXECUTIVE SUMMARY

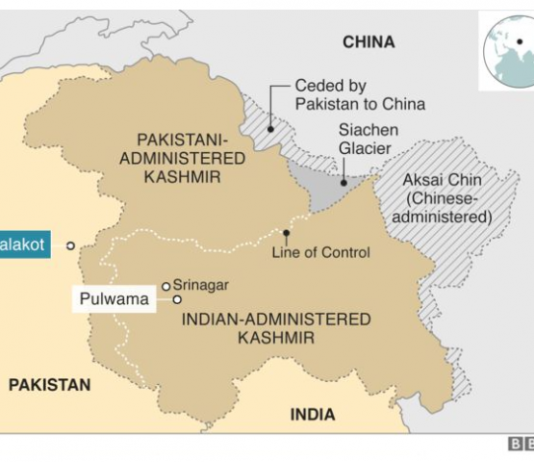

Post the downing of the Indian Air Force (IAF) MIG-21 by Pakistan over its territory and the capture and subsequent return of the...

EXECUTIVE SUMMARY

The air strikes launched by the Indian Air Force on Jaba Top in Balakot, in the Khyber Pakhtunkhwa province of Pakistan, have raised...

EXECUTIVE SUMMARY

Yes Bank is in the cross hairs of the Reserve Bank of India (RBI), the banking regulator. On February 13, 2019, the bank...

EXECUTIVE SUMMARY

The ‘Interim Report of IL&FS and Its Subsidiaries’ dated November 30, 2018 by the Serious Fraud Investigation Office (SFIO), which was submitted by the Ministry...

EXECUTIVE SUMMARY

The press statement issued by ICICI Bank based on the enquiry report headed by Justice (Retd.) Srikrishna to investigate the allegations against Chanda Kochhar appears...

EXECUTIVE SUMMARY

Yes Bank has appointed Ravneet Gill as the bank’s CEO, effective latest from March 1, 2019, for a 3-year term. The announcement led...

EXECUTIVE SUMMARY

The Central Bureau of Investigation (CBI), India’s premier federal police investigation agency, finally filed a First Information Report (FIR) and charged Chanda Kochhar, former CEO,...

By Hemindra Hazari

On January 11, 2019, the Reserve Bank of India (RBI) issued a press release informing the public that “by an order dated January 4, 2019...