On January 11, 2019, the Reserve

Bank of India (RBI) issued

a press release

informing the public that “by an order dated January 4, 2019 imposed

a...

EXECUTIVE SUMMARY

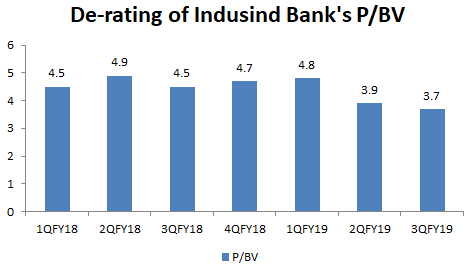

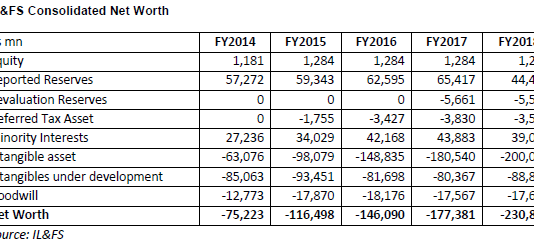

Indusind Bank’s reckless decision to provide a Rs 20 bn (8% of the bank’s capital) unsecured bridge loan to IL&FS, an insolvent infrastructure...

EXECUTIVE SUMMARY

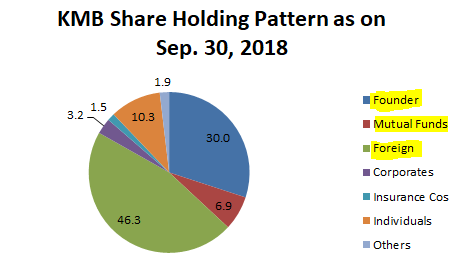

The deadline (December 31, 2018) for Uday Kotak, the founder-CEO of Kotak Mahindra Bank (KMB), to dilute his stake to 20% has come...

In an unprecedented act, Kotak Mahindra Bank (KMB) on December 10, 2018 filed a writ petition in the Bombay high court against the Reserve Bank of...

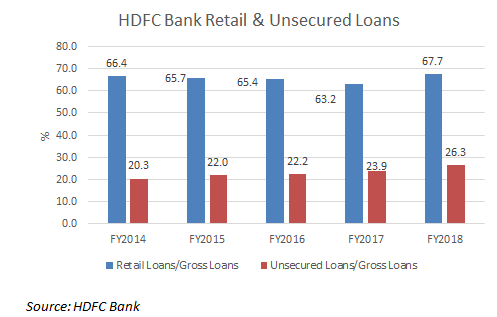

For the last 5 years, the profitability of HDFC Bank, India’s largest

bank by market capitalisation, has declined even though its critical net

interest margin (NIM)...

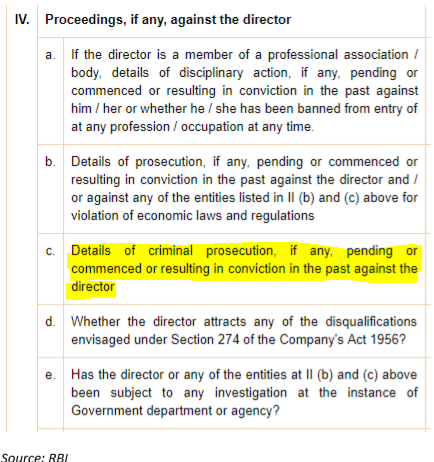

Mumbai: It is the season of resignations for the independent directors of India Inc’s corporate boards.

The recent stormy exit of R. Chandrashekhar from the board of Yes Bank caught...

Claudius, in Hamlet, noted that “When sorrows come, they come not single spies but in battalions.”

He could well have been speaking about the woes of...

Leadership is

unravelling at Yes Bank and the stock is tanking. In the dark hours of November

14, the bank announced the immediate resignations of Ashok...

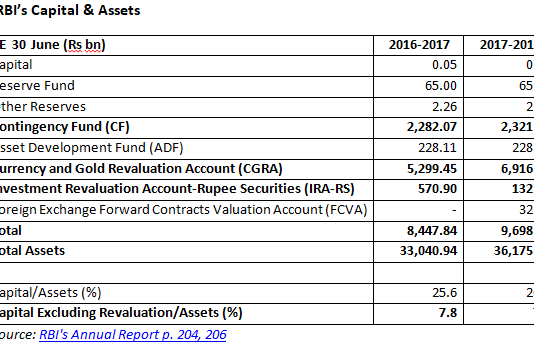

The unseemly public jostling between India’s central bank and the government of India casts a poor light on both institutions. Adhering to unrealistic fiscal...

Romesh Sobti, CEO, Indusind Bank, is a veteran banker with 43 years’ experience. He recently went on record to defend the bank’s substantial bridge...