One might think that the ICICI Bank board, worried at the beating its image has taken in recent months, might try to restore public...

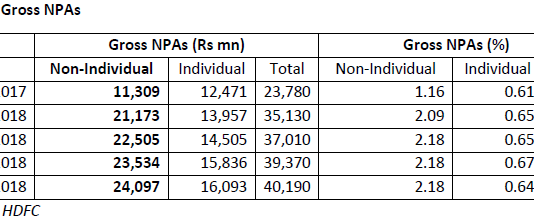

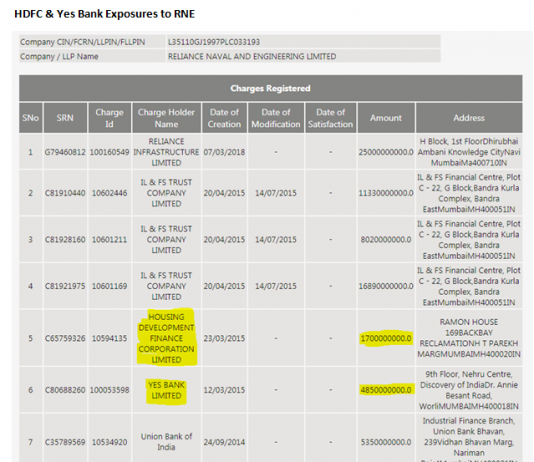

In an earlier insight, More Transparency Was Expected From HDFC Regarding Its Reliance Naval Exposure, on April 19, 2018, this writer had cautioned that...

It seems miracles

do happen. The lame walk, the dying return to life, the blind see – well, maybe

not the last, if they are sell-side...

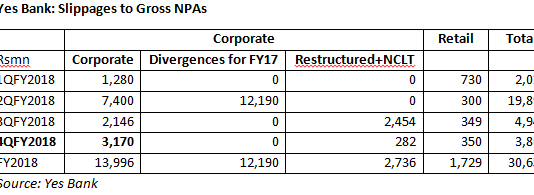

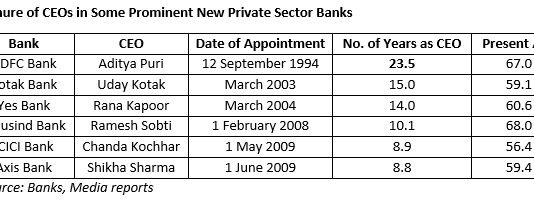

In a stunning blow to the credibility of Indusind Bank, its board of directors, Ramesh Sobti, chief executive officer and Russell I Parera, auditor...

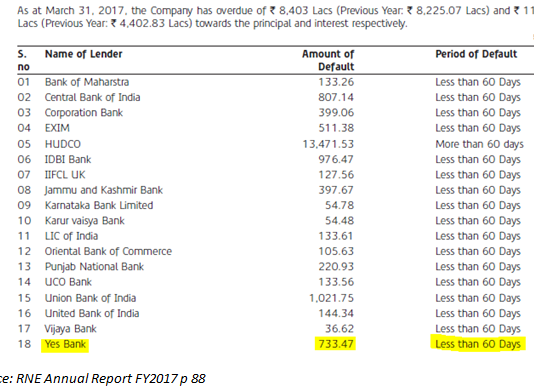

Reliance Naval Engineering (RNE) will in all

likelihood be classified as non-performing by all the concerned banks in the

consortium for the quarter ended March 31,...

Reliance

Naval Engineering (RNE) will in all likelihood be classified as non-performing

by all the concerned banks in the consortium for the quarter ended March 31,

2018....

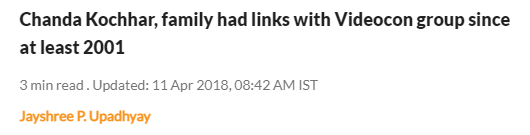

The ICICI Bank Board recently staged a ringing defence of its Chief Executive Officer (CEO), Chanda Kochhar with a categorical press statement reposing trust...

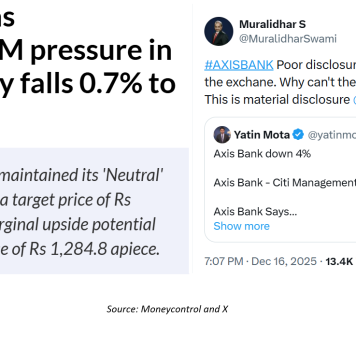

After the Reserve Bank of India (RBI) made clear to the board of Axis Bank that it should reconsider its decision to grant the...

If Chanda Kochhar had disclosed her husband's dealings and recused herself from the credit committee that sanctioned the Videocon loan, her personal integrity would...

The shimmering lustre of India’s crown jewel of banking, HDFC Bank, is attributed to its chief executive officer (CEO), Aditya Puri. In a span...