EXECUTIVE SUMMARY. According to the grand theory of capitalism and the free market, competition anoints the customer as king. In the capital market, it is argued that increasing the number of players would improve price discovery, and greater scrutiny of managements’ conduct would discipline them. Thus the market would...

EXECUTIVE SUMMARY

Yes Bank has appointed Ravneet Gill as the bank’s CEO, effective latest from March 1, 2019, for a 3-year term. The announcement led to a spurt in the bank’s share price, as the leadership issue was finally resolved. While investors rejoiced, it remains to be seen whether the...

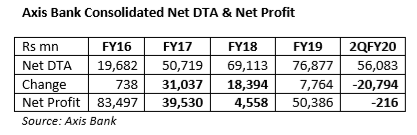

EXECUTIVE SUMMARY. The market ignored Axis Bank’s consolidated net loss of Rs 216 mn in 2QFY2020. Though sell-side analysts were not expecting this result, they nevertheless bought the bank’s explanation that this was “one-time” in this “quarter of transition”, as deferred tax assets (DTA), which are intangible assets, were...

Kotak Mahindra Bank (KMB) sent the following response to this analyst’s article, “KMB Talks of “Highest Standards of Corporate Governance”, But Avoids Telling Shareholders about Adverse SEBI Orders against Executive Director” (dated August 3, 2022; it was later released to the general public as well, on grounds of public...

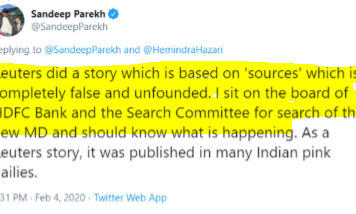

Hemindra Hazari

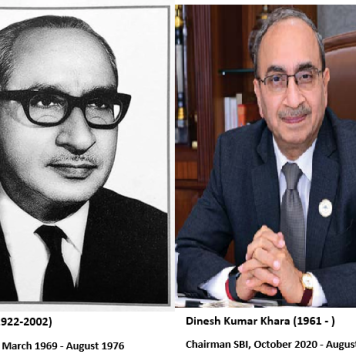

In India’s darkest economic hour, with the economy starved of cash, the prime minister extolling the people on the virtues of sacrifice and the Reserve Bank of India (RBI) governor finally emerging from his 14-day absence and silence to reassure citizens, one critical individual has gone “missing”. A...

A Kotak family entity, Infina Finance Private Ltd. (Infina), purchased electoral bonds totalling Rs 1.3 billion – which is more than twice the amount disclosed by the State Bank of India (SBI) to the Election Commission of India (ECI) during FY2019 to FY2022.

In FY2020, the company purchased Rs 760...

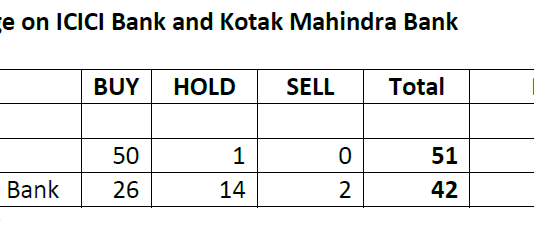

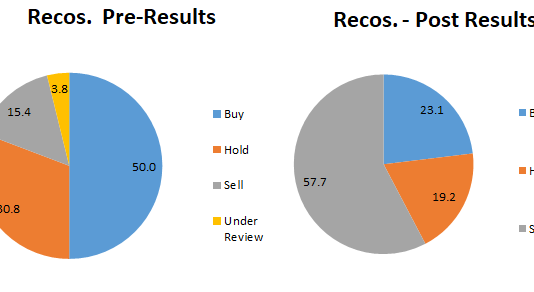

The pitifully situation in sell-side research is on account of their inability to publicly question or even condemn the management of the companies they cover and expose accounting fraud, mismanagement and mis-governance.

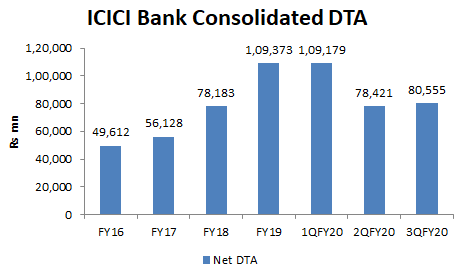

EXECUTIVE SUMMARY. Although ICICI Bank reported a strong performance in 3QFY20, the market has ignored the increase in the deferred tax asset (DTA) which inflated the net profit by Rs 2 bn. It would have been more prudent for the bank to continue with its earlier practice in 1QFY20...