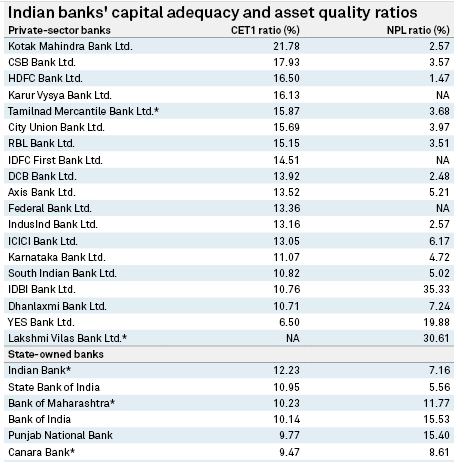

India will likely need to pump in additional capital into any state-owned banks it puts on the block to make them attractive for potential buyers, and faces challenges that range from the need to amend the nation's banking laws to hostile employee unions, analysts say.

Finance Minister Nirmala Sitharaman said...

“Indian rating companies are reluctant to give poor ratings to companies before the default happens,” said independent analyst Hemindra Hazari, “They fear losing their clients.”

AuthorRanina Sanglap Gaurav RaghuvanshiThemeBanking

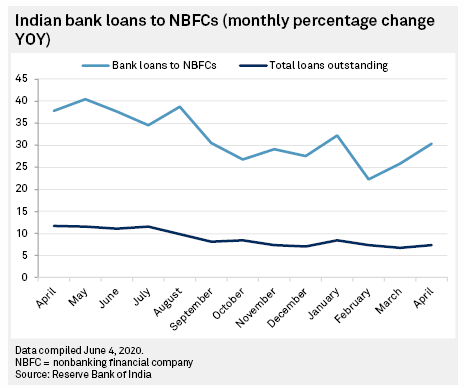

Many Indian nonbanking financial companies may remain short of funds as investors become more cautious and the economy contracts, adding risks to the broader financial system.

Indian authorities have recently stepped up efforts to improve liquidity for nonbanking financial companies, or NBFCs, as the coronavirus pandemic halted the economy...

The role of independent directors is clearly defined, yet many of them feel they play a cameo role in a company, often failing to red flag fraudulent activity and serious governance lapses that eventually compromise minority shareholders' interests

BY NEHA BOTHRA 11 min readPUBLISHED: May 4, 2022 11:02:32 AM ISTUPDATED: May 4, 2022...

The audit income of Deloitte, EY, PwC, and KPMG could be hit due to the new capping and mandatory joint audit norms. They are auditing more than a dozen non-bank lenders and will have to give up many clients to comply with the mandate of the regulator.

Mannu AroraETCFOMay 03,...

13 Sep, 2020Zia Khan Gaurav Raghuvanshi Mohammad Abbas Taqi

Banking

India's state-owned banks have lagged behind their private-sector peers in tapping equity capital markets so far this year and are likely to remain dependent on government capital injections amid depleted market valuations and rising bad loans in a pandemic-battered economy, analysts...

G.R. Gopinath DECEMBER 02, 2020 00:15 IST UPDATED: DECEMBER 01, 2020 22:58 IST

They will not only enrich themselves but also crush competition

First, a confession is in order. Would I want to own a bank and have a key to the bank treasury to start a new airline? You bet! Can...

Banks in India might never be in for a more challenging, or should one say, exciting phase. In the next two years, some of the biggest new private sector banks in India—ICICI Bank, Axis Bank, Yes Bank, IndusInd Bank and HDFC Bank—will have new leaders.

The exits of the leaders...

3 min read. Updated: 29 Oct 2020, 09:39 AM IST Tauseef Shahidi , Nikita Kwatra

Indian CEOs are increasingly likely to ‘resign’ rather than retire, a Mint analysis shows

Top Indian corporate leaders last fewer years in office than politicians do. A chief executive officer or managing director of an average BSE 500 company...