Adam Tooze Jan 28

Article can be read here

“Indian rating companies are reluctant to give poor ratings to companies before the default happens,” said independent analyst Hemindra Hazari, “They fear losing their clients.”

Author Gaurav Raghuvanshi Rebecca Isjwara

DBS Group Holdings Ltd.'s ambitions to grow in India may get a leg up after the nation's central bank proposed it take over Lakshmi Vilas Bank Ltd., an ailing local lender, by infusing 25 billion rupees of additional capital.

LVB, a 94-year old lender based in...

13 Sep, 2020Zia Khan Gaurav Raghuvanshi Mohammad Abbas Taqi

Banking

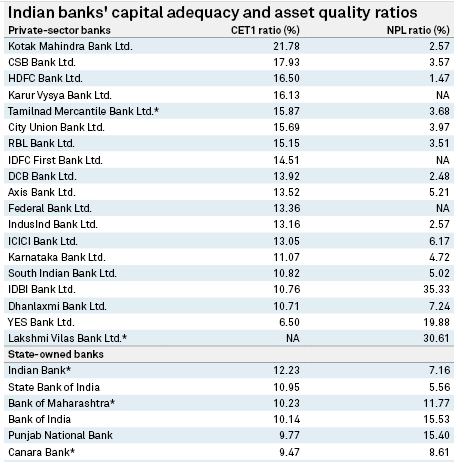

India's state-owned banks have lagged behind their private-sector peers in tapping equity capital markets so far this year and are likely to remain dependent on government capital injections amid depleted market valuations and rising bad loans in a pandemic-battered economy, analysts...

"He should have resigned earlier [if he was peeved]…. You can’t be like an independent commentator in position of office and make statements which are destabilising,” Hazari told Forbes India.

BY CHARLIE CAMPBELL / SINGAPORE

JANUARY 30, 2023 6:00 AM EST

Article can be read here

“The fine of 20 million rupees is insignificant but the risk of the RBI placing restrictions on the bank has gone up substantially,” said independent analyst Hemindra Hazari

RBI measures won't affect existing customers. Similar measures could be taken for larger banks that faced recent outages

TopicsHDFC Bank | RBI | Digital banking

Subrata Panda & Anup Roy | Mumbai Last Updated at December 4, 2020 01:20 IST

The Reserve Bank of India (RBI) on Thursday morning directed the country’s largest private sector lender, HDFC Bank, to temporarily...

By Quentin Webb and Shefali Anand Updated Nov. 22, 2021 7:27 am ET