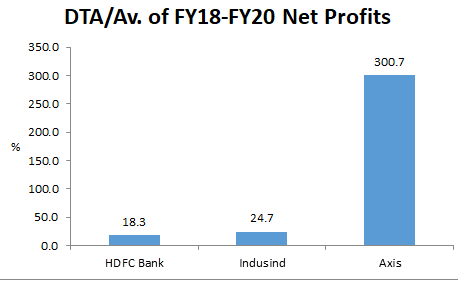

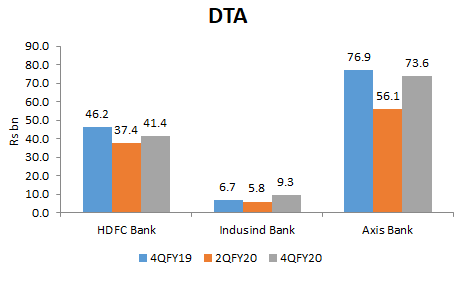

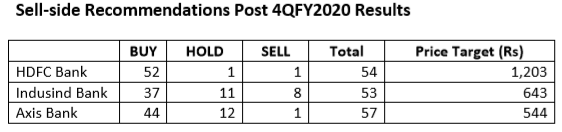

EXECUTIVE SUMMARY. In the case of all the three prominent private sector banks (HDFC Bank, Indusind Bank and Axis Bank) that have declared 4QFY2020 results, sell-side analysts and the business media have chosen to ignore the role of deferred tax assets (DTA) in inflating 2HFY2020 net profits. Even though AS-22 treats DTA as a short term intangible asset, it is not prudent accounting to create, or keep increasing, DTA. Shockingly, in the analyst conference calls for all three banks, not a single question was posed on DTA and the inflation in net profits, or regarding how the banks will have to reverse this intangible asset in the near future, depressing earnings in those (future) years. Either the sell-side does not comprehend DTA, or, since the majority of them are positive on these banks, they do not want to factor in the reversal of DTA, which would depress their future estimates and price targets.

While HDFC Bank’s consolidated net profits adjusted for DTA in 2HFY2020 were 3% lower than the reported number, the corresponding figure for Indusind Bank was lower by a significant 22%, and Axis Bank was the worst impacted, with an adjusted 2HFY20 consolidated loss of Rs 11.4 bn, as against a reported consolidated net profit of Rs 6 bn. Nobody is concerned regarding how banks are increasing the DTA and the policy for the eventual reversal of this short term intangible asset. As future bank profits are likely to come under severe strain, the overhang of DTA will put further pressure on earnings and Axis Bank is the most vulnerable. It appears the auditors are satisfied with the management’s viewpoint, and the audit committees of the boards are merely endorsing such policies. The Reserve Bank of India, as usual, is a mute bystander, and is content to watch banks merrily use DTA to inflate earnings. Such is the state of governance and regulation in the banking industry.