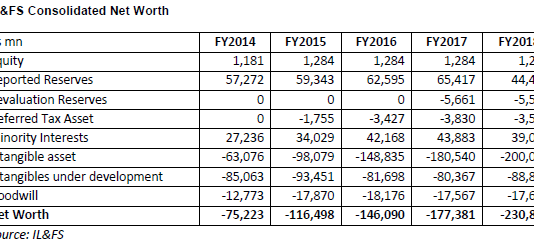

Romesh Sobti, CEO, Indusind Bank, is a veteran banker with 43 years’ experience. He recently went on record to defend the bank’s substantial bridge loan to the fast-collapsing IL&FS, a systemically important non-deposit-taking core investment company. Sadly, he found this writer’s earlier insight on Indusind to be “nasty” and...

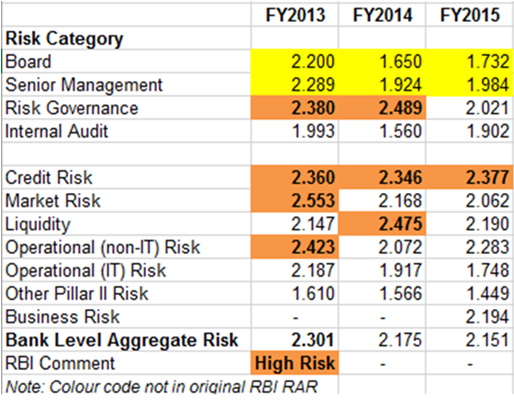

EXECUTIVE SUMMARY. Under the threat of being pulled up for contempt of court by the Supreme Court of India, the Reserve Bank of India (RBI) finally disclosed the confidential inspection reports, called Risk Assessment Reports, of some banks requested under the Right to Information Act (RTI), 2005. The reports,...

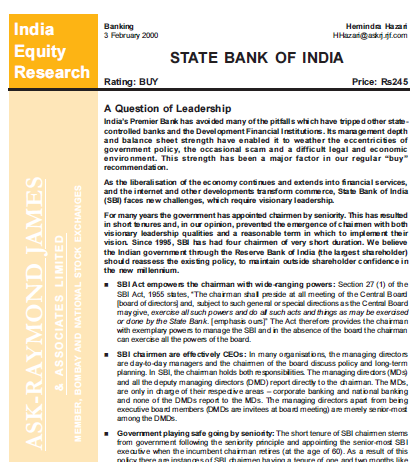

Post this report and the subsequent media coverage, the Indian government changed the selection policy of appointment of SBI chairman solely on the basis of seniority.

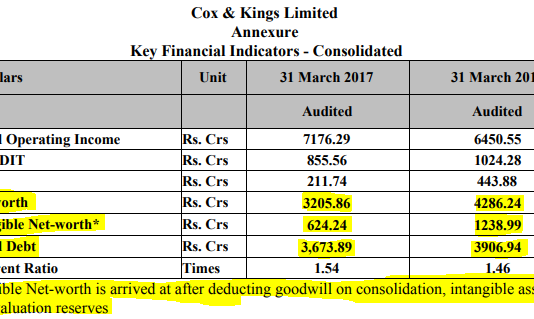

The appalling record of incompetence, and likely worse, by India’s credit rating agencies (CRAs) continues to lengthen. The latest instance is the double default of commercial debt obligations (on June 27 and July 1, 2019) by Cox and Kings, a tour and travels services company. In this case the...

Sunlight is said to be

the best disinfectant; it is also considered fatal for vampires. Whatever be

the reason, the ICICI Bank board has decided to take no chances of the

slightest ray falling on its murky recesses. It has appointed a complete

insider to replace Chanda Kochhar, the bank’s CEO-under-investigation.

Ms Kochhar, who...

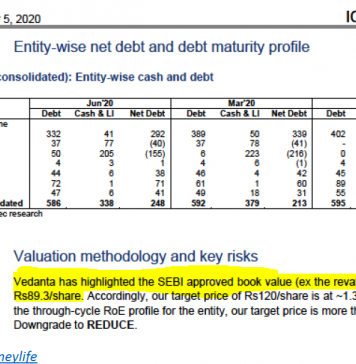

EXECUTIVE SUMMARY. April 1, 2020, All Fools Day, the first day of FY2021, was an eventful day for Kotak Mahindra Bank (KMB) shareholders, as the share price fell an alarming 9% as compared with a NIFTY-50 decline of 4% and the NIFTY Bank fall of 5%. What should be...

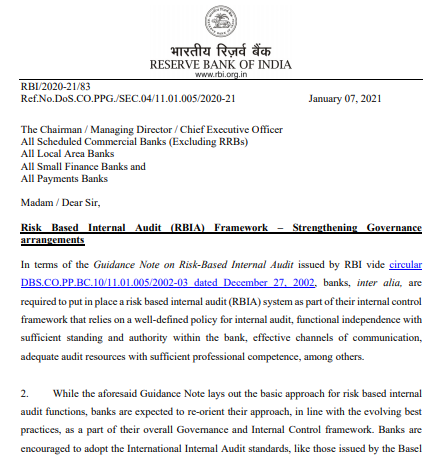

EXECUTIVE SUMMARY. On January 7, 2021 the Reserve Bank of India (RBI) issued instructions to commercial banks to safeguard the independence and competence of the internal audit function, and laid down norms for the functioning of the department and the appointment of the head of internal audit. While it...

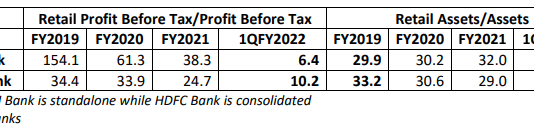

EXECUTIVE SUMMARY. ICICI Bank’s 1QFY2022 results on July 24, 2021 highlight the need for shareholders to re-examine the bank’s retail asset strategy. ICICI Bank’s strategy was to focus on retail assets to compensate for the bulky poor-quality corporate assets that it had earlier emphasised. However, the broad economic slowdown...

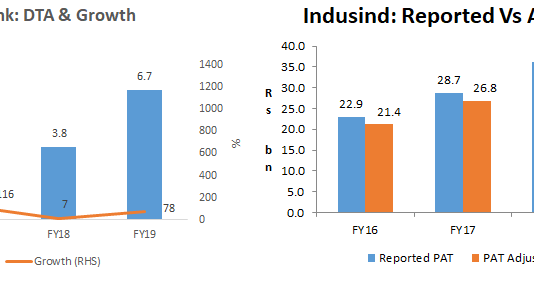

EXECUTIVE SUMMARY. Indusind Bank not only declared 4QFY2019 results far below consensus expectations, but FY2019 net profits have been inflated by a significant increase in net deferred tax asset (DTA). As usual, the business media and sell-side analysts have ignored the significance of the rise in DTA in inflating...

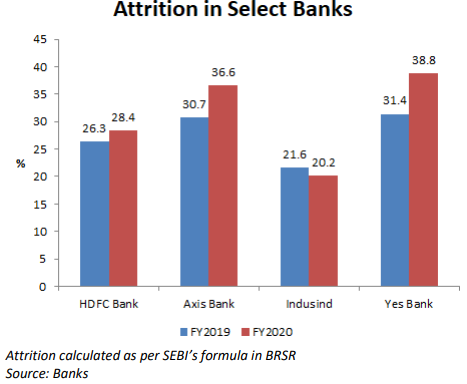

EXECUTIVE SUMMARY. While Axis Bank has recovered from its corporate non-performing asset (NPA) crisis, it seems to be in the midst of a management attrition problem, partly explained by significant sackings in FY2020. Staff turnover levels have been steadily rising in the period FY2018 – FY2020 (FY2021 data is...