Directors’ role on company boards has become more complex and demanding, especially for independent directors. Increasingly they have to monitor and manage diverse stakeholders’...

On October 21, 2023, Kotak Mahindra Bank (KMB) surprised the market by announcing that “the Reserve Bank of India (RBI) approved the appointment of...

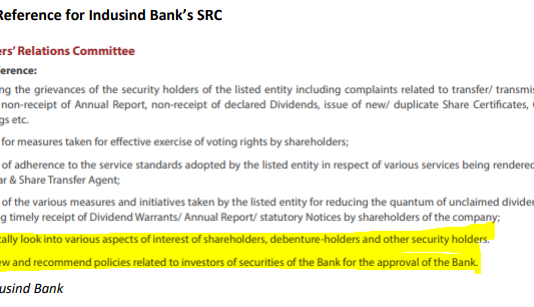

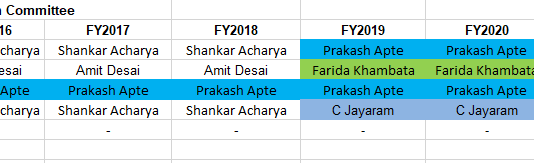

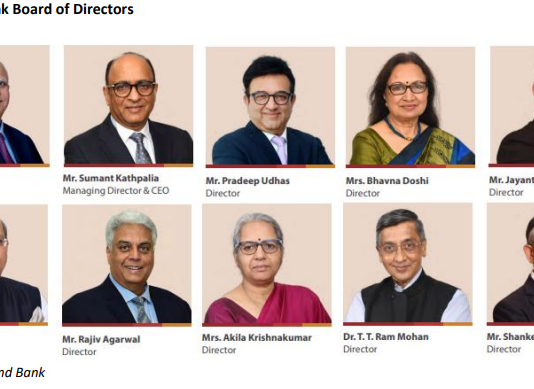

Indusind Bank: When Half the Staff Left, Why Didn’t Independent Directors Think It Worth Mentioning?

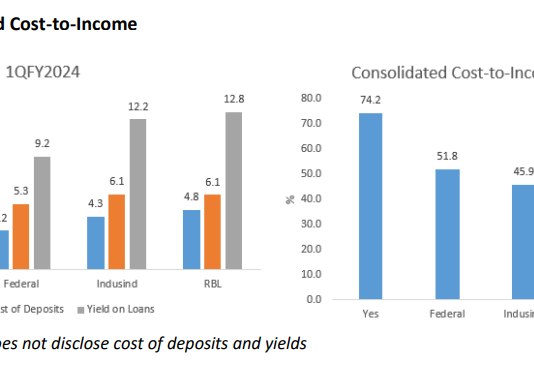

Private sector banks’ high and sharply rising attrition is in the spotlight, thanks to the mandatory disclosures in banks’ annual and business sustainability reports...

It has been 3½ years since the Reserve Bank of India imposed a moratorium on Yes Bank, superseded its board, and organised a financial...

Toxic work culture is rife in the Indian financial sector and it is rare for senior executive management to acknowledge abusive behaviour by managers....

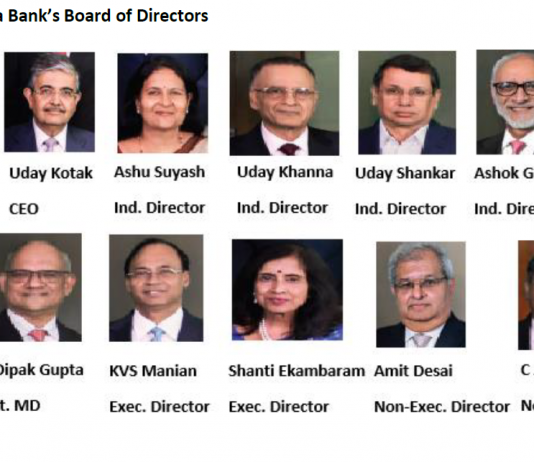

It is Uday Kotak’s swan song year as chief executive officer of Kotak Mahindra Bank (KMB), and the theme of the bank’s FY2023 annual...

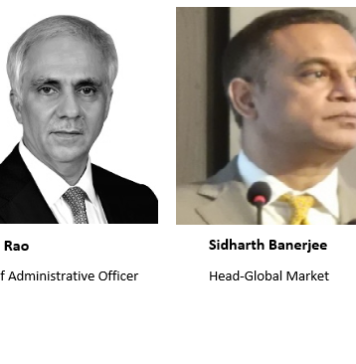

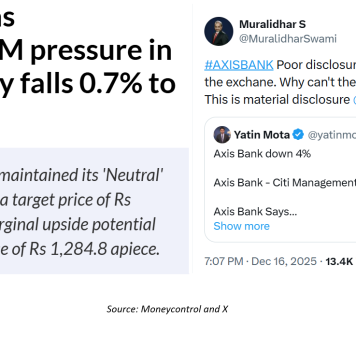

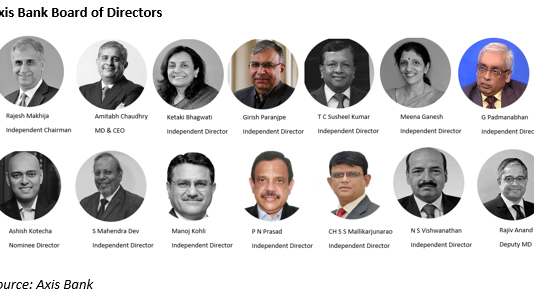

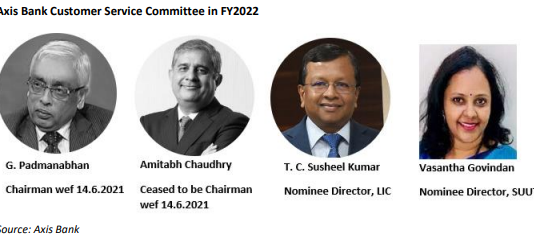

The overriding theme of Axis Bank’s FY2023 annual report (released on June 26, 2023) is “Open, to Win Together”. The catch phrase is reiterated...

The gap between Axis Bank’s own portrayal of customer experience and the reality of customer complaints recalls Robert Louis Stevenson’s classic tale of Dr....

In the wake of the collapse of Silicon Valley Bank (SVB) in the United States of America on March 10, 2023, the United States...

Banks are considered special, but Kotak Mahindra Bank (KMB) and its high profile founder-CEO, Uday Kotak are extraordinarily special (here and here). Ever since...