The RBI’s decision on April 26, 2021 to curtail tenures of bank chief executive officers and executive directors may finally lead to Kotak relinquishing his post at the end of 2023.

Had the Reserve Bank of India (RBI) descended, like Moses, from Mount Sinai, perhaps it would have carried two sets of Commandments: one for ordinary mortals; and another, more relaxed, set for Uday Kotak, founder-CEO of Kotak Mahindra Bank.

The first set would be carved on stone tablets for all eternity; the second would be written in pencil on paper, with several erasures and revisions. Whether with regard to the directives for dilution of promoter stake in banks, or the maximum tenure of bank chiefs, Kotak enjoys a special status. Nor does the RBI proffer any explanation for this glaring anomaly.

The RBI’s decision on April 26, 2021 to curtail tenures of bank chief executive officers and executive directors may finally lead to Kotak relinquishing his post at the end of 2023.

What is disturbing to note, however, is how partial the regulator has been in the matter of granting extensions to private sector bank CEOs.

When the RBI surrendered on the question of promoter

This partiality has a long history. In February 2013, the RBI had laid down that the promoter stake in private banks must be reduced to 15% within 12 years of commencement of business. For years, Uday Kotak resisted implementing this directive, and in response the RBI serially carved out specific relaxations for him and his bank. When the RBI finally decided to crack the whip, Kotak Mahindra Bank, in an unprecedented action, took the regulator to court (on December 10, 2018), exchanging harsh language with the RBI in court documents.

Surprisingly, the RBI decided to settle the case out of court on January 30, 2020, on terms favourable to Uday Kotak: it permitted him to keep an equity stake in the bank of 26%, and not 15% as mandated for other promoters of private banks.

A man checks his phone outside the Reserve Bank of India (RBI) headquarters in Mumbai, India, April 5, 2018. Photo: Reuters/Francis Mascarenhas/Files

On November 24, 2020, after the RBI had made this special exception for Uday Kotak without any explanation to the public, an Internal Working Group of the RBI recommended that promoter shareholding in a private sector bank may be raised from 15% to 26%. In effect, the RBI first made an exception for an individual bank, and thereafter proposed to change the norm for the rest of the industry. It appears that, rather than the RBI framing policy for the banks, Kotak was framing policy for the RBI.

On June 11, 2020, the RBI released a discussion paper on governance where it proposed that the tenure for promoter CEO or whole-time director (WTD) be restricted to ten years.

The paper stated, “To build a robust culture of sound governance practice, professional management of banks and to adopt the principle of separating ownership from management, it is desirable to limit the tenure of the WTDs or CEOs. Therefore, it is felt that 10 years is an adequate time limit for a promoter / major shareholder of a bank as WTD or CEO of the bank to stabilise its operations and to transition the managerial leadership to a professional management.” (page 54)

For non-promoter/major shareholder CEO/WTD the RBI proposed to restrict the tenure to 15 years; thereafter the individual could be reappointed after a gap of three years.

As Uday Kotak’s term as CEO was coming to an end on December 31, 2020, and since he had been the founder-CEO of the bank for 17 years (well over the 10 year-period proposed by the RBI) it was believed that he would have to step down, or the RBI would approve a short term extension so as to allow the bank to select his successor. However, despite the immediate past history of Kotak Mahindra Bank dragging the regulator to court, on December 14, 2020 the regulator approved a three-year extension as CEO (till December 31, 2023) for the 62-year-old Uday Kotak.

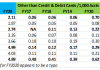

What is revealing is that while RBI gave Uday Kotak a three-year extension, it was far less generous with other bank CEOs:

* Shyam Srinivasan, CEO, Federal Bank, is a couple of years younger than Uday Kotak, and had served as a non-promoter CEO for nearly ten years (he was appointed on September 23, 2010). A month after the RBI released its discussion paper on corporate governance, he was given an extension of only one year – in July 16, 2020, for a term ending on September 21, 2021.

* Murali Natarajan, the 59-year-old CEO of DCB Bank, had been appointed on April 29, 2009, and had served for 12 years as CEO. Four months after RBI approved Kotak’s three-year extension, Natarajan was given a one-year extension by the RBI on April 16, 2021 (till April 28, 2022).

On April 26, 2021, the RBI announced its policy for age limit and length of tenures of bank CEOs and WTD. The age limit for CEOs is capped at 70 years. For promoter CEOs/WTDs the tenure is limited to 12 years, and under special circumstances the regulator can relax it to 15 years. For non-promoter CEOs/WTDs the tenure is capped at 15 years. The notification specifically stated:

“Banks with MD and CEOs or WTDs who have already completed 12/15 years as MD and CEO or WTD, on the date these instructions coming into effect, shall be allowed to complete their current term as already approved by the Reserve Bank.”

Chronology

The sequence of events is telling.

On June 11, 2020, the RBI released a discussion paper and proposed to cap the tenures of CEOs. The then 58-year-old Shyam Srinivasan was given a one-year extension by the RBI on July 16, 2020.

On December 14, 2020, the RBI approved the then 61-year-old Uday Kotak for a three-year term. Conveniently for Kotak, it is only four months later that the RBI issued its directive that promoter CEOs/WTDs can have a tenure of 12 years, and with RBI’s discretion can continue till 15 years. As noted above, two other non-promoter CEOs who were younger than Kotak and whose tenures as CEO were less than Kotak were given a third of the extension that was granted to Kotak. Pertinently, when the RBI approved Uday Kotak’s extension in December 2020, he already had a tenure of 17 years, and hence would not even have qualified for another extension.

In sum, a policy is proposed in June 2020; in the interim Kotak is granted an extension going directly against the proposed policy; the policy is finally announced only in April 2021, and it specifically exempts extensions already granted.

In public, Uday Kotak has been a strong critic of cronyism. But by coincidence, repeated RBI decisions have benefitted him; more importantly, those very benefits were denied to others in the industry. In the last 17 years, RBI has kept giving special concessions to Uday Kotak and Kotak Mahindra Bank. Not only do the latter not fear the regulator, but they have the confidence to challenge the RBI’s actions in a court of law. It is a rare event in any jurisdiction to find a bank legally challenging the banking regulator, and even rarer for the regulator to meekly surrender in an out-of-court settlement.

The RBI’s repeated favourable treatment of Uday Kotak and his bank, despite a long history of non-compliance with regulatory guidelines pertaining to lowering the promoter equity shareholding, is a lesson in how a single, influential private sector banker can game the regulatory system to his advantage. The RBI does not seem to be concerned that playing favourites undermines its credibility as an impartial regulator and makes a mockery of its regulation.

Timeline of Events

| Date | Event |

| December 10, 2018 | Kotak Mahindra Bank (KMB) files writ petition against RBI to maintain promoter equity holding to 26% and not 15% |

| January 30, 2020 | KMB announces that RBI is willing to do out-of-court settlement and agrees to keep maximum promoter equity stake at 26% for KMB |

| June 11, 2020 | RBI discussion paper proposes to cap tenure of promoter-CEO to 10 years and non-promoter CEO to 15 years |

| July 16, 2020 | RBI approves one-year extension for Shyam Srinivasan, CEO, Federal Bank till September 21, 2021 |

| November 24, 2020 | RBI Internal Group proposes increasing the maximum equity shareholding in private sector banks to 26% from 15% |

| December 14, 2020 | RBI approves three-year extension for Udak Kotak as CEO effective January 1, 2021 |

| April 16, 2021 | RBI approves one-year extension for Murali Natarajan, CEO, DCB Bank till April 28, 2022 |

| April 26, 2021 | RBI issues guidelines for fixing maximum tenure for CEOs to 12/15 years for promoter-CEOs and 15 years for non-promoter CEOs |

Source: RBI, banks

Hemindra Hazari is a Securities and Exchange Board of India (SEBI)-registered independent research analyst. He has no exposure to the companies mentioned in this report.