EXECUTIVE SUMMARY. Despites the paeans of self-praise in annual reports, exposé after exposé by the media reveal the abysmal state of corporate governance in private financial capital. The latest in these revelations by ET Prime is how Yes Bank disbursed a Rs 5.12 bn loan to Oyster Buildwell, an Avantha (Thapar) group shell company which had less than Rs 50 mn in capital and negligible income at end December 2017/early January 2018. While the then founder-Chief Executive Officer (CEO), Rana Kapoor, has been rightly held responsible for the collapse of Yes Bank (subsequently revived by a State Bank of India-led group), and is currently a guest of the state, what has gone largely unnoticed is how members of the then board of directors were equally culpable and have gotten away scot free.

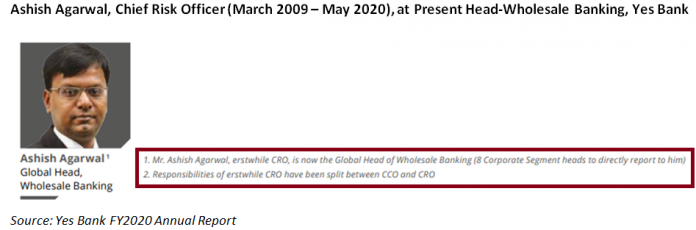

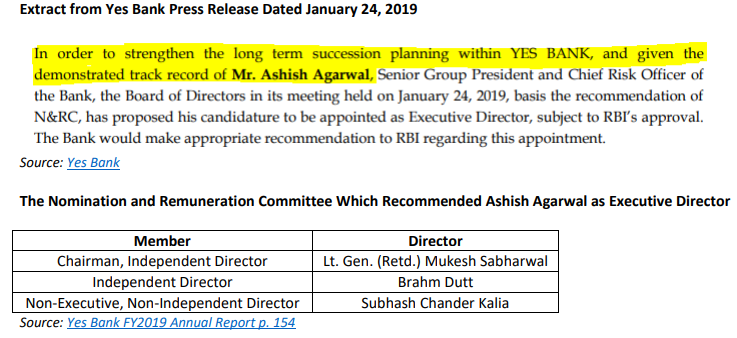

More alarming is the case of Ashish Agarwal, the Chief Risk Officer (CRO) and also responsible for corporate loans for more than a decade (March 2009 to May 2020), who appraised and approved all the dubious corporate loans (including Oyster Buildwell) which ultimately brought the bank to its knees: he was rewarded by the board of directors in January 2019 for his “track record” and put forward as a possible successor to Rana Kapoor, by elevating him to the post of executive director. When the Reserve Bank of India (RBI) rightly rejected his candidature, he continued in the all-important CRO post till May 2020, whereupon he was put in charge of wholesale and corporate lending. That an individual who approved a series of dubious high-risk corporate loans not only survived but was rewarded under the new ownership and management, when he should have been removed, is indicative of all that is wrong in private financial capital today and in Yes Bank in particular.

What is equally shocking is that the RBI’s extreme leniency in its annual inspections of Yes Bank, when it reviewed large loans given to shell companies having marginal equity and income and dubious security provided by third parties, as revealed in the Oyster Buildwell case. Such loans — euphemistically and mistakenly referred to by the current management as “asset backed financing” — were in reality high-risk loans, which no experienced commercial banker should have undertaken. It is on account of these rare media scoops that the public becomes aware of the brazen incompetence/complicity of the board of directors and key senior executives, and the negligence of the banking regulator in not taking action at the relevant time, thereby putting public deposits at risk.

In Yes Bank’s case, stakeholders should demand accountability and punishment of the then board of directors (including independent directors) who were complicit, and key executives like the then CRO, who blindly condoned reckless lending and approved poor quality loans. The RBI belatedly acted by ending Kapoor’s term as CEO on January 31, 2019, even though Vishal Goyal, the UBS sell-side analyst, first highlighted concerns of poor quality loans in July 2015, and this analyst kept blowing the whistle from May 2017 onwards. This shows how lethargically the banking regulator responded, despite having access to all the inside information rightly denied to sell-side analysts. The Oyster Buildwell loan lucidly reveals how all prudent norms of lending were thrown to the winds, and how the then CRO was rewarded by the then owners of Yes Bank, as well as later by the new owners.

DISCLOSURE

I, Hemindra Hazari, am a Securities and Exchange Board of India (SEBI) registered independent research analyst (Regd. No. INH000000594). I own equity shares in Yes Bank and HDFC Bank mentioned in this report. Yes Bank subscribes to this analyst’s research. Views expressed in this Insight accurately reflect my personal opinion about the referenced securities and issuers and/or other subject matter as appropriate. This Insight does not contain and is not based on any non-public, material information. To the best of my knowledge, the views expressed in this Insight comply with Indian law as well as applicable law in the country from which it is posted. I have not been commissioned to write this Insight or hold any specific opinion on the securities referenced therein. This Insight is for informational purposes only and is not intended to provide financial, investment or other professional advice. It should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security.