EXECUTIVE SUMMARY. In the last 3 years, studies have revealed the unprecedented acceleration and concentration of profits and economic power accruing at the pinnacle of corporate India. The large corporates have become bigger and the small corporates have fallen further behind. This has happened not only on account of...

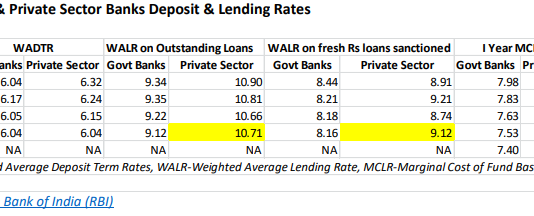

EXECUTIVE SUMMARY. Data from the Reserve Bank of India (RBI) reveal that, in the recent period of declining interest rates, while all banks have been reducing their deposit rates as well as their benchmark rates (marginal cost of fund-based lending rates), in July 2020 private sector banks have increased...

Banks are considered special, but Kotak Mahindra Bank (KMB) and its high profile founder-CEO, Uday Kotak are extraordinarily special (here and here). Ever since KMB was granted a banking license in 2003, Uday Kotak has been its CEO. As per the Reserve Bank of India’s directive, he will have...

The quality and intellectual calibre of the former directors of insolvent IL&FS was revealed to all when an anonymous former director and ex-member of its risk management committee of the board went on record with a Business Standard journalist to justify the incompetence of the board. Such conduct may...

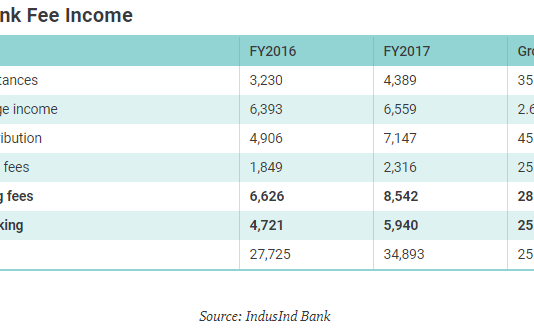

IndusInd Bank’s quarter ended March 31, 2017 (4QFY2017) was impacted by a “one-off” exposure to a company whose cement operations is in the process of being acquired by a top-rated company. While sell-side analysts regard it as a blip in the secular positive outlook on the bank, they are...

EXECUTIVE SUMMARY. Institutional investors were recently in the news for opposing a 10% pay hike for a CEO-promoter in FY2021, a year of bad results for his firm. One big story went unremarked: that the latest pay hike was on a high base, since the CEO had received a 51% pay hike...

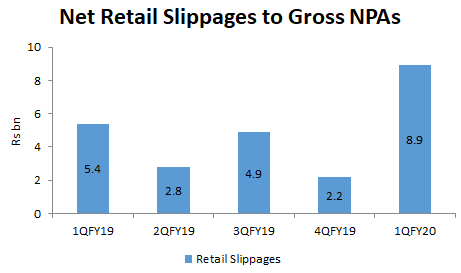

EXECUTIVE SUMMARY. The market has not been kind to Axis Bank after its 1QFY2020 results. The share price has fallen 7%, as compared with a fall in the NIFTY of only 2%. While analysts have raised concerns on the elevated credit costs and high slippages to gross non-performing assets,...

Hemindra Hazari 4 March 2017

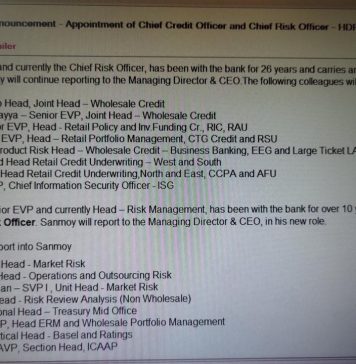

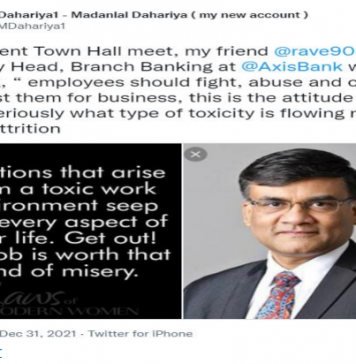

Axis Bank has had a tough year. Just as it was slowly recovering from the demonetisation fiasco, wherein some of its officials were arrested for money laundering, its non-watch list corporate loans slipped into the non-performing category in the third quarter of FY’2017. In the last month, news...

Hemindra Hazari

Everyone knows public sector banks are less profitable, more prone to political influence and have higher ratios of non-performing assets (NPAs) than their private sector counterparts. In contrast, new private sector banks, set up post 1991, are media and stock market darlings. Most analysts tend not to mention...