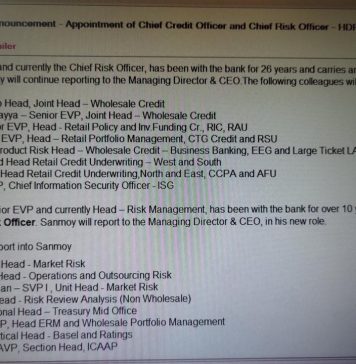

The resignation of Viral Acharya, deputy governor, Reserve Bank of India (RBI) six months before his term was to end, was preceded by the resignation of Urjit Patel. Earlier, Raghuram Rajan failed to get a second term as RBI governor. However, these developments did not bring on the “wrath...

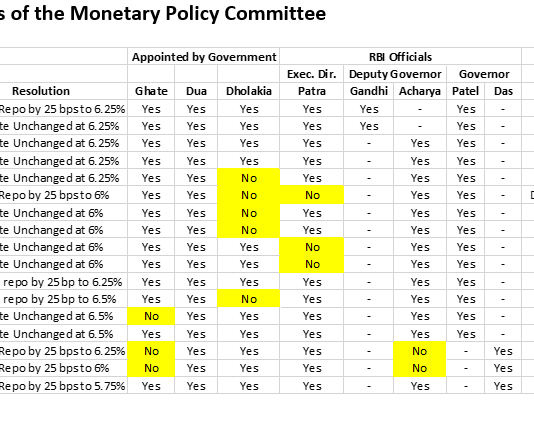

EXECUTIVE SUMMARY. On June 14, 2019, Tech Mahindra joined the ranks of Tata Global Beverages, Ambuja Cement and Dr Reddy’s in appointing Shikha Sharma as an independent director. Private equity firm KKR had also appointed Sharma as an adviser for their alternative investments. The irony of publicly-owned and listed...

EXECUTIVE SUMMARY. Documents of the Reserve Bank of India (RBI), like those of most central banks, are usually dry, sober statements of fact and analysis. Thus readers of the RBI’s April 2021 State of the Economy document would have sat up and rubbed their eyes as they read its...

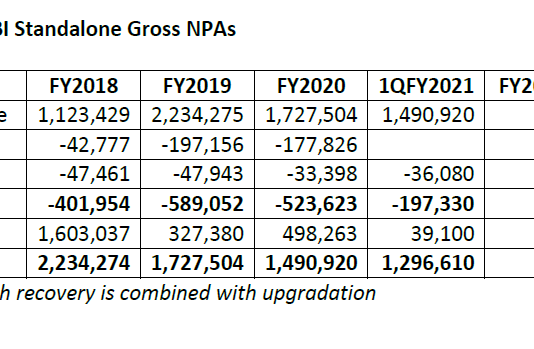

EXECUTIVE SUMMARY. Media commentators analysing the tenure (October 7, 2017 to October 6, 2020) of Rajnish Kumar as chairman of the State Bank of India , India’s largest bank by assets, have commented on the sharp decline in gross non-performing assets (GNPAs) in absolute and in percentage terms during...

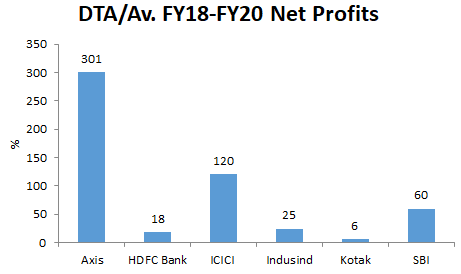

EXECUTIVE SUMMARY. At a time when many private sector banks such as HDFC Bank, ICICI Bank, Axis Bank, Indusind Bank and Yes Bank have increased their deferred tax asset (DTA) in 2HFY2020 as compared with 1HFY2020, thereby inflating their net profits in the period, it is heartening to observe...

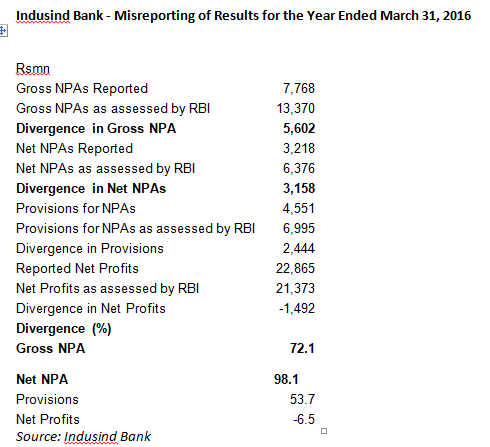

In a stunning blow to the credibility of Indusind Bank, its board of directors, Ramesh Sobti, chief executive officer and Russell I Parera, auditor and partner, Price Waterhouse, the bank reported that it had mis-reported its accounts for the year ended March 31, 2017. This was its second consecutive...

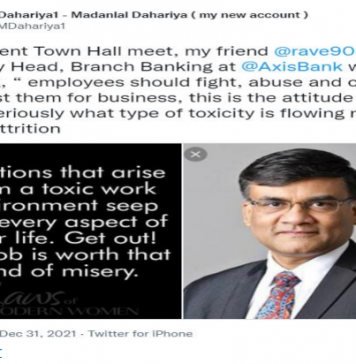

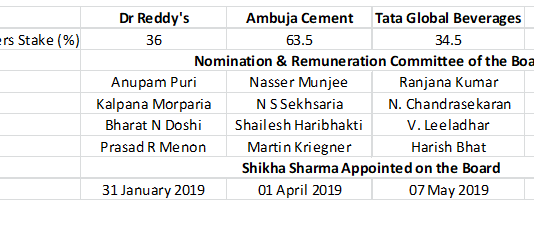

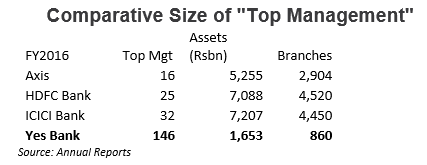

Credibility issues have plagued Yes Bank’s asset quality disclosures in the earlier (year ending March 31, 2016) annual report, added to these concerns is a top heavy organisational structure with significant expansions and contractions in the “top management” category in the last 2 years without any explanation in the...

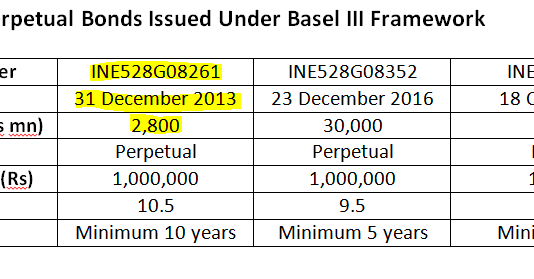

In Ian Fleming’s iconic James Bond movie franchise, the dapper 007 manages to get away, however precarious the situation. Similarly, in Yes Bank, one Additional Tier 1 Capital (AT1) perpetual bond issued under Basel III classification has escaped from being written down. In the wide publicity that the write...

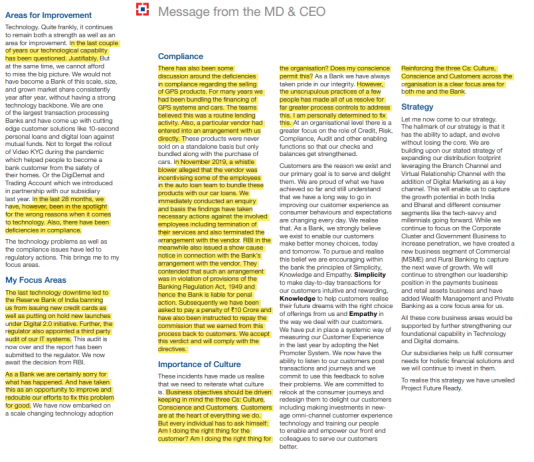

Retail-focused

new private sector banks, the darlings of the capital market, are facing the

ire of the banking regulator. Nearly two months after the Reserve Bank of India

(RBI) compelled HDFC Bank to classify a large account as non-performing, thus

qualifying the blue-blooded bank for ‘divergence’ (from RBI findings), comes

news that the regulator...

EXECUTIVE SUMMARY. There is a surprising change in the public profiles of the Chief Executive Officers (CEOs) of India’s first and second largest private sector banks, HDFC Bank and ICICI Bank. What are the implications?

Both Sashidhar Jagdishan and Sandeep Bakshi stepped into the shoes of high-profile predecessors: the iconic...