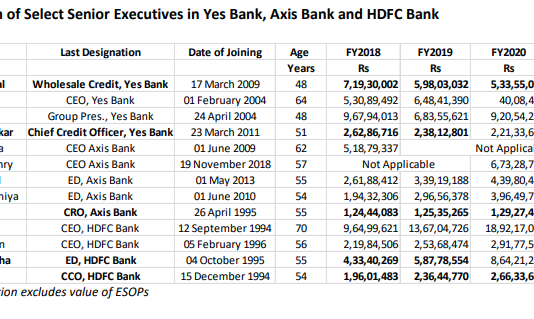

EXECUTIVE SUMMARY. Institutional investors were recently in the news for opposing a 10% pay hike for a CEO-promoter in FY2021, a year of bad results for his firm. One big story went unremarked: that the latest pay hike was on a high base, since the CEO had received a 51% pay hike...

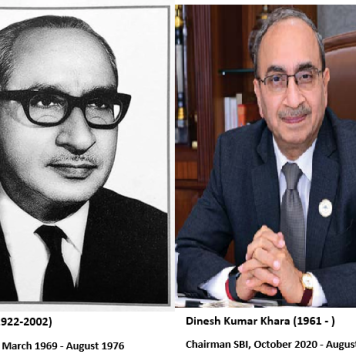

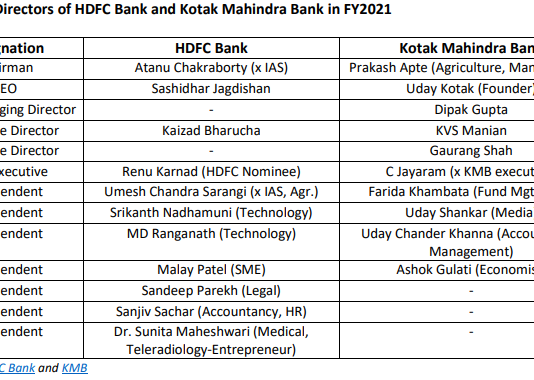

EXECUTIVE SUMMARY. A notable feature in HDFC Bank and Kotak Mahindra Bank (KMB) is the historical absence of any commercial banking expertise amongst the independent directors on the boards. The founders (HDFC and Uday Kotak) and the Nomination and Remuneration Committee in both banks, as a deliberate strategy, have...

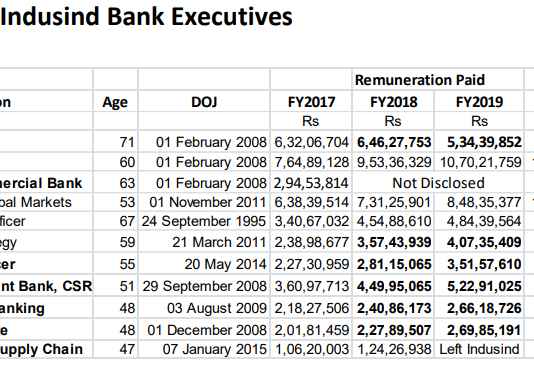

EXECUTIVE SUMMARY. Most private sector banks withhold the remuneration details of senior executives in the annual reports. However, shareholders can specifically request this disclosure from companies. The remuneration disclosure provides valuable information on the quantum of monetary compensation, revealing how senior managers have been appraised and compensated.

In Indusind Bank,...

EXECUTIVE SUMMARY. Pay obscene remuneration to a favoured few, completely out of sync with the already inflated salary structure in the industry, silently watch as they bring the bank to near collapse – this was Yes Bank’s policy for senior management. It is not surprising that this was done...

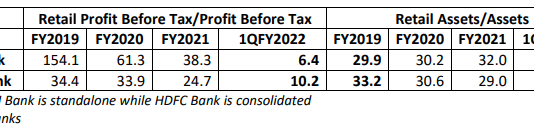

EXECUTIVE SUMMARY. ICICI Bank’s 1QFY2022 results on July 24, 2021 highlight the need for shareholders to re-examine the bank’s retail asset strategy. ICICI Bank’s strategy was to focus on retail assets to compensate for the bulky poor-quality corporate assets that it had earlier emphasised. However, the broad economic slowdown...

EXECUTIVE SUMMARY. Despites the paeans of self-praise in annual reports, exposé after exposé by the media reveal the abysmal state of corporate governance in private financial capital. The latest in these revelations by ET Prime is how Yes Bank disbursed a Rs 5.12 bn loan to Oyster Buildwell, an...

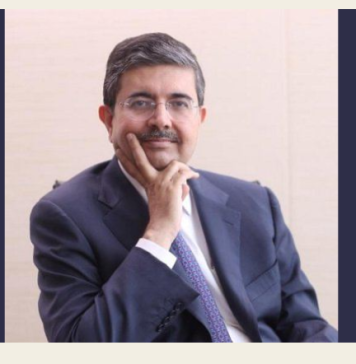

EXECUTIVE SUMMARY. There is a surprising change in the public profiles of the Chief Executive Officers (CEOs) of India’s first and second largest private sector banks, HDFC Bank and ICICI Bank. What are the implications?

Both Sashidhar Jagdishan and Sandeep Bakshi stepped into the shoes of high-profile predecessors: the iconic...

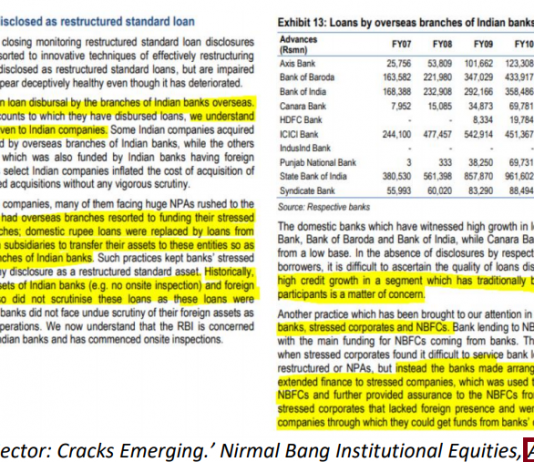

EXECUTIVE SUMMARY. The ET Prime 3-part series based on the Securities and Exchange Board of India’s (SEBI) show cause notices to Standard Chartered Bank, Indusind Bank and Aditya Birla Finance highlighted the manner in which these institutions allegedly ‘evergreened’ their exposure and shifted their loans from the unlisted Thapar...

EXECUTIVE SUMMARY. Yet another instance has come to light of the practice of disguising transactions by routing them through shell companies. As revealed by ET Prime, the Securities and Exchange Board of India (SEBI) issued show cause notice to Aditya Birla Finance (ABF) on the latter’s alleged role in...

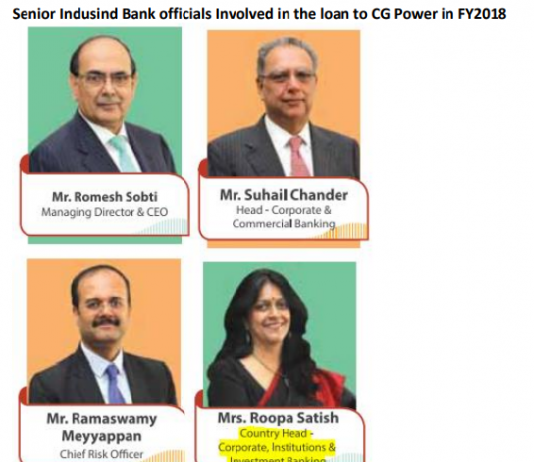

EXECUTIVE SUMMARY. In a major scoop, ET Prime on June 9, 2021 revealed the contents of the Securities and Exchange Board of India (SEBI)’s ongoing investigation into Indusind Bank’s October 2017 US$ 40 mn loan to CG Middle East FZE (CG ME), a step down subsidiary of CG Power...