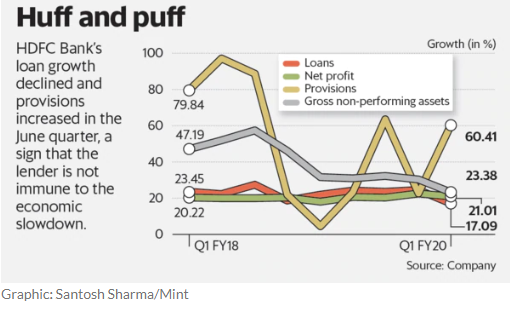

"It would have been a shocker if RBI would have approved the merger. I am surprised RBI did not announce its decision earlier as the entity was in the news for the wrong reasons,” asserts research analyst Hemindra Hazari.

“In the current faltering economy, the bank is unlikely to increase its net interest margin and its fees to compensate for the expected higher credit costs and if it is unable to continue with its earlier strategy, shareholders should expect a decline in its profitability," Hazari wrote in a note

“Indian rating companies are reluctant to give poor ratings to companies before the default happens,” said independent analyst Hemindra Hazari, “They fear losing their clients.”

Altico Capital's default could put more pressure on Yes Bank's balance sheet and lead to greater scrutiny

BY SALIL PANCHAL, Forbes India Staff 2 min read PUBLISHED: Sep...

Sitharaman's decision to merge 10 banks into four may be riddled with leadership and decision-making challenges

BY SALIL PANCHAL, Forbes India Staff 3 min read PUBLISHED: Sep 10,...

Swati Bhat, Nupur Anand 4 MIN READ

MONEY NEWSJULY 14, 2019 / 7:32 PM /

DHFL reported a net loss of 22.23 billion rupees...

"He should have resigned earlier [if he was peeved]…. You can’t be like an independent commentator in position of office and make statements which are destabilising,” Hazari told Forbes India.

An independent banking analyst Hemindra Hazari wrote a report questioning the corporate governance practices of companies which have employed her.

“The fine of 20 million rupees is insignificant but the risk of the RBI placing restrictions on the bank has gone up substantially,” said independent analyst Hemindra Hazari

“Some would call it strange for the same auditor to audit competing banks in the same year. What is even more unusual is that the accounts certified of both the banks by the same, individual statutory auditor have been found misleading by the statutory regulator,” Hazari had written in one of his columns for The Wire.