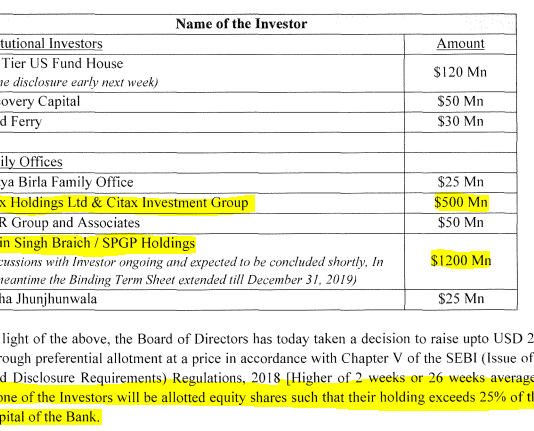

EXECUTIVE SUMMARY. On November 29, 2019, Yes Bank finally revealed the names of the prospective investors for their US$ 2 bn equity issue. Unfortunately, 90% of the issue consisted of family offices and the 3 family offices which accounted for 85% of the issue were relatively unknown names. It...

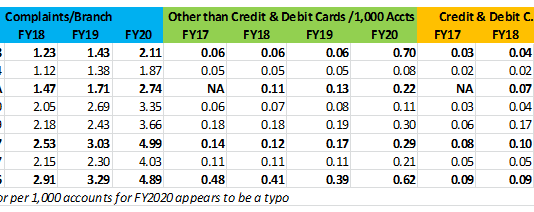

EXECUTIVE SUMMARY. The capital markets continue to reward private sector banks with rich valuations, benefitting shareholders. But larger stakeholders such as bank customers are registering a steep increase in complaints to the banks’ ombudsman. For the year July 1, 2019 to June 30, 2020, customer complaints (per branch and...

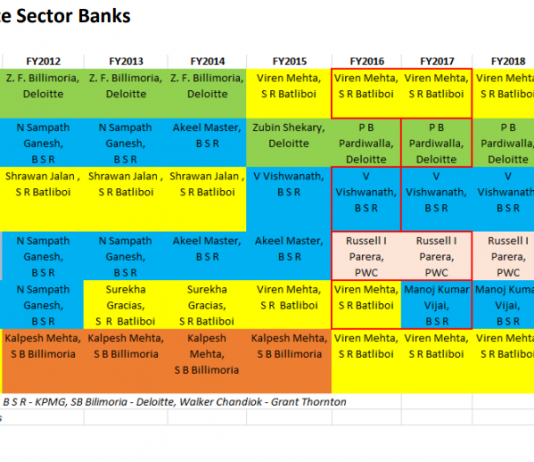

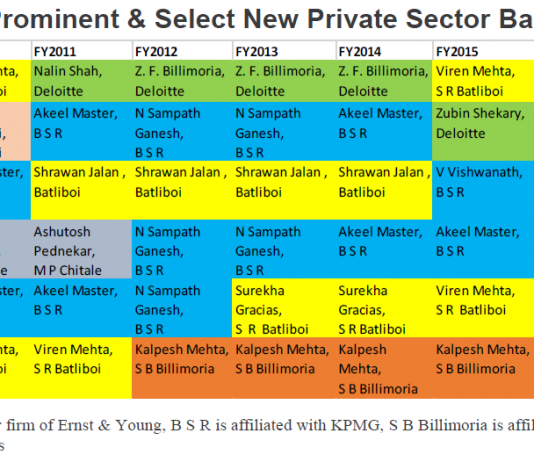

EXECUTIVE SUMMARY. The integrity of audits in private sector banks and non-bank financial companies (including housing finance) has received a major boost, while large global and domestic audit firms have been dealt a body blow by the Reserve Bank of India’s new guidelines for the appointment of statutory auditors...

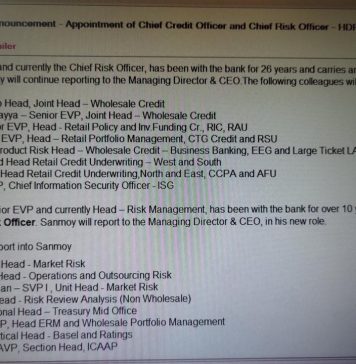

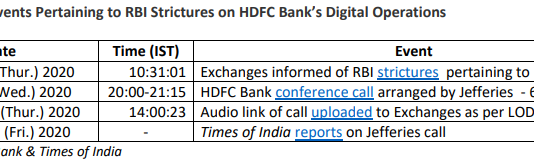

EXECUTIVE SUMMARY. It was unfortunate that HDFC Bank decided to provide selective disclosure at a conference call hosted by Jefferies. Only 63 institutional investors participated on the evening of December 9, 2020, where the bank publicly disclosed what went wrong at its recent digital outages. More importantly, in the...

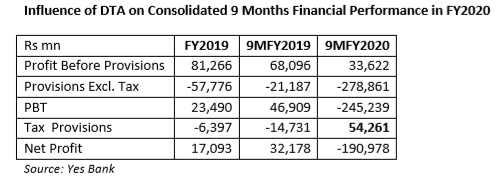

EXECUTIVE SUMMARY. Yes Bank reported a staggering consolidated net loss of Rs 191 bn ($2.6 bn) for the 9 month period ended December 31, 2019 (for 3Q FY2020 the net loss was Rs 185.6 bn). However, even this is understated on account of the huge increase in the deferred...

Hemindra Hazari

Equity research analysts produce impressive reports, operate complex statistical models, and can talk confidently about the future on the business channels. But the past year has not been kind to the fundamental predictions of most analysts.

In particular, there is a strong inbuilt bias of analysts to remain bullish....

EXECUTIVE SUMMARY. In a little-publicised step, the Securities and Exchange Board of India (SEBI) has directed the first 1,000 companies by market capitalisation on the Indian bourses to disclose voluminous information in their business responsibility and sustainability reporting. For FY2022 this is voluntary, but from FY2023 it is to...

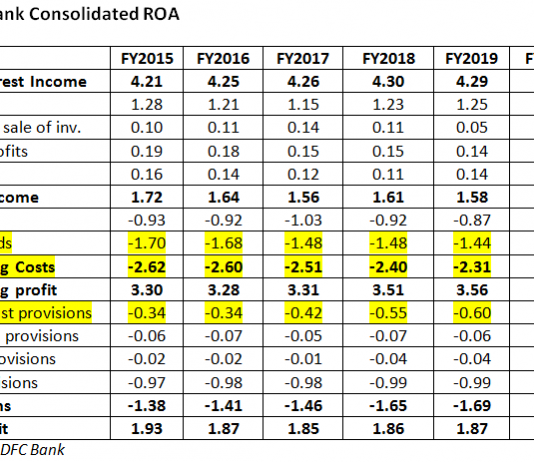

EXECUTIVE SUMMARY. On the eve of HDFC Bank’s 2QFY2020 results (October 19, 2019), an analysis of its profitability for the last 5 years reveals that, while its ROA marginally declined as credit costs increased, it was the leveraging of operating costs which compensated to maintain the bank’s excellent profitability....

A liquidity crisis of such a magnitude is not an overnight phenomena yet the credit rating agency certified the compnay as investment grade thereby misinforming bond holders and bankers

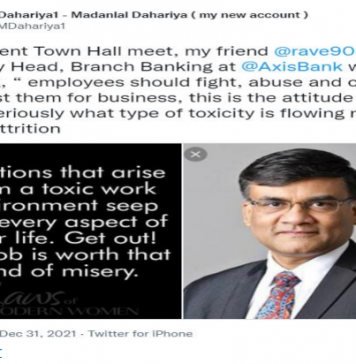

It is extremely unfortunate that the regulatory agencies have till date not penalised any senior individual in the banks or the partners in the audit firms responsible for the huge divergence in NPAs in FY2016. The lack of punishment so far raises concerns of ‘regulatory capture’ by the private sector banks.