In response to the Reserve Bank of India’s (RBI) directive to Yes Bank to replace the present CEO-promoter Rana Kapoor by January 31, 2019, the bank’s share price fell a stunning 29% on September 21, and Rs 20,937 crores of market capitalisation went up in smoke.

The RBI’s directive is...

Hemindra Hazari

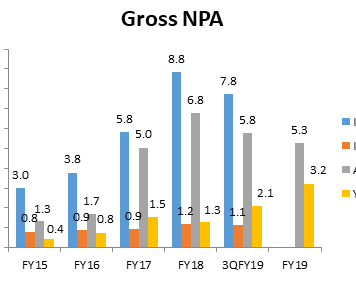

ICICI Bank, India’s largest private sector bank by assets, posted shocking results for the quarter ended March 31, 2016. The consensus analyst forecast for the bank’s net profit was Rs. 3,100 crores; the bank reported a paltry Rs. 702 crores. This was an annual decline of 76% (compared to Rs....

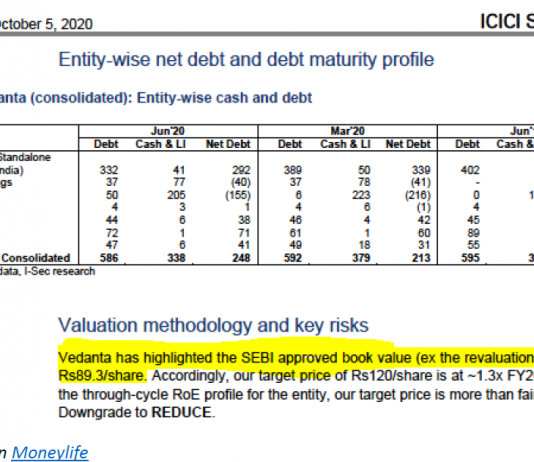

EXECUTIVE SUMMARY. On the opening date of Vedanta’s delisting offer (October 5, 2020), ICICI Securities (I-Sec) issued a results research note on Vedanta with the following bizarre statement: “Vedanta has highlighted the SEBI approved book value (ex the revaluation reserves) of Rs 89.3/share.” I-Sec, a listed subsidiary of...

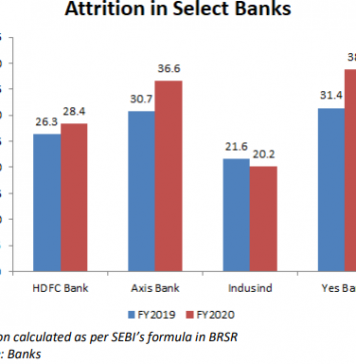

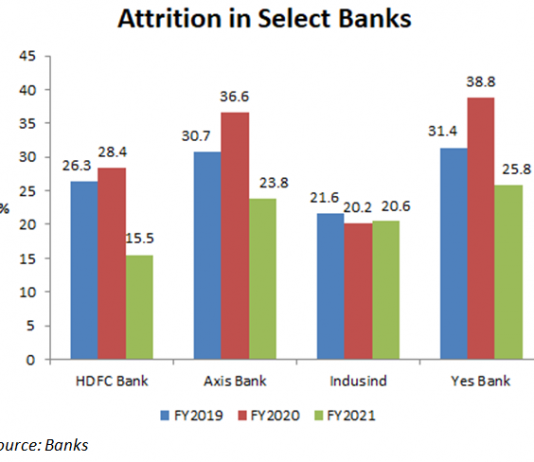

EXECUTIVE SUMMARY. Indusind Bank shareholders are paying a heavy price for senior executive-level reorganisation in Bharat Financial Inclusion (BFI), which backfired as disgruntled BFI seniors blew the whistle on alleged evergreening. Meanwhile the corporate division of the bank has being undergoing a similar drastic reorganisation.

For some years this analyst...

Tucked away in the notes to the 4QFY2025 accounts of Karnataka Bank, a century-old regional private sector bank which once enjoyed a conservative reputation, is a very alarming note. It should have raised huge corporate governance concerns among stakeholders and even more so the Reserve Bank of India (RBI),...

EXECUTIVE SUMMARY. Even though Axis Bank reported an impressive growth in net profit, higher than that of its peers, the stock market penalised the bank, as the growth of its business, top line and profit before provisions was lower than that of its peers. The stock market traditionally favours...

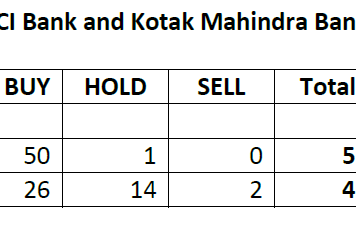

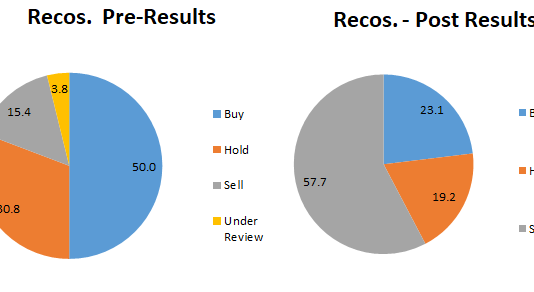

The pitifully situation in sell-side research is on account of their inability to publicly question or even condemn the management of the companies they cover and expose accounting fraud, mismanagement and mis-governance.

Hemindra Hazari

In India’s darkest economic hour, with the economy starved of cash, the prime minister extolling the people on the virtues of sacrifice and the Reserve Bank of India (RBI) governor finally emerging from his 14-day absence and silence to reassure citizens, one critical individual has gone “missing”. A...

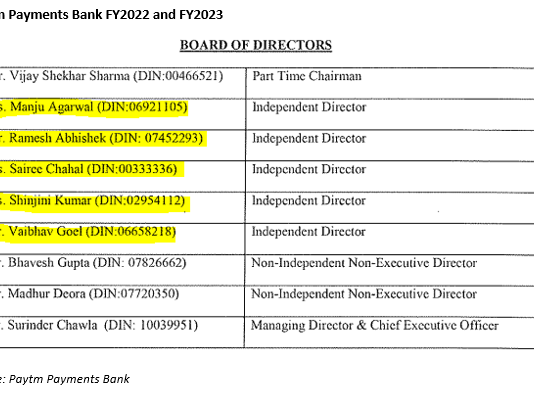

Three new developments herald a possible new beginning for Paytm Payments Bank (PPB): The reconstitution of its board of directors, apparently due to pressure from the Reserve Bank of India (RBI); the stepping down of Vijay Shekhar Sharma (51% shareholder of PPB) as part-time chairman and the induction of...

EXECUTIVE SUMMARY. The IDFC’s board of directors’ decision to reclassify Vinod Rai, hitherto independent director, as a non-independent non-executive director provides a backdoor entry for all those independent directors whom founders/promoters and executive management want to retain after the mandated two consecutive terms.

In the critical financial sector there is...