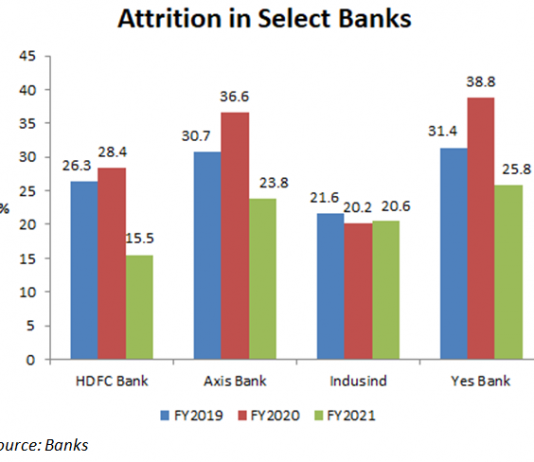

EXECUTIVE SUMMARY. Even though Axis Bank reported an impressive growth in net profit, higher than that of its peers, the stock market penalised the...

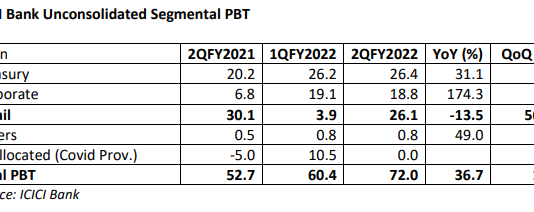

EXECUTIVE SUMMARY. ICICI Bank reported strong profits for 2QFY2022, with standalone net profits increasing by 30% YoY to Rs 55 bn., enthusing the market....

EXECUTIVE SUMMARY. Government banks have been derided for indulging in ‘phone banking’ (being instructed on the telephone by ruling party politicians and civil bureaucrats...

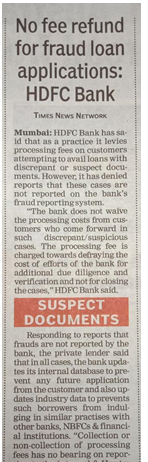

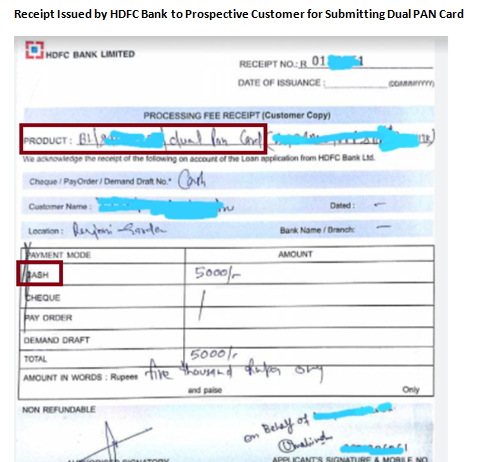

EXECUTIVE SUMMARY. This analyst’s research note on September 24, 2021 highlighted HDFC Bank’s disturbing practice of extracting ‘processing fees’ from prospective customers who applied...

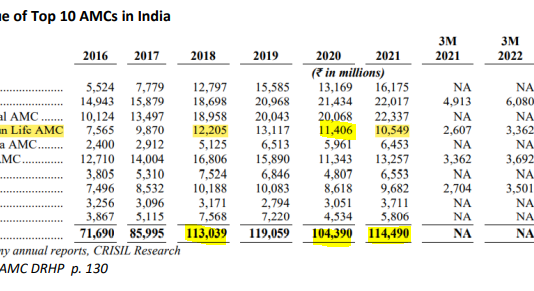

EXECUTIVE SUMMARY. In the midst of Aditya Birla Sun Life Asset Management Company’s (ABSL AMC) Initial Public Offering (IPO), prospective investors should be aware...

EXECUTIVE SUMMARY.

“hush money”: money paid to someone to prevent them from disclosing embarrassing or discreditable information – Concise Oxford English Dictionary

HDFC Bank, India’s...

EXECUTIVE SUMMARY. The IDFC’s board of directors’ decision to reclassify Vinod Rai, hitherto independent director, as a non-independent non-executive director provides a backdoor entry...

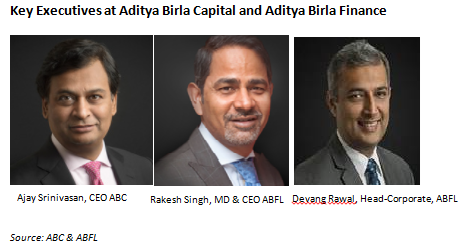

EXECUTIVE SUMMARY. Senior executives are rushing for the exit door at Aditya Birla Finance Ltd. (ABFL), the non-bank finance company (NBFC) subsidiary of Aditya...

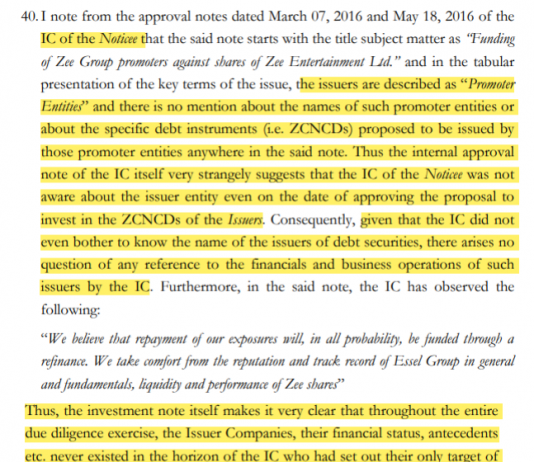

EXECUTIVE SUMMARY. The Securities and Exchange Board of India (SEBI)’s order penalising Kotak Mahindra Mutual Fund (Kotak MF), a subsidiary of Kotak Mahindra Bank...

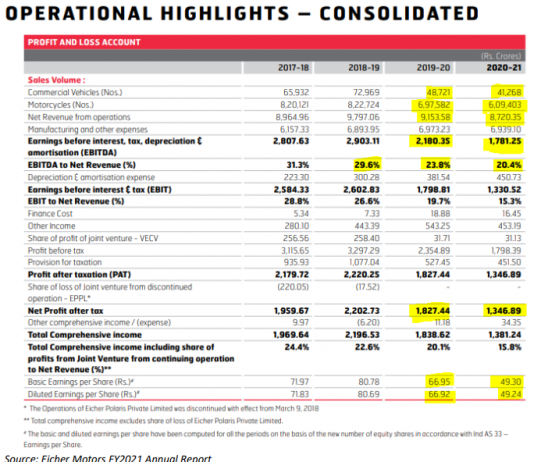

EXECUTIVE SUMMARY. Institutional investors were recently in the news for opposing a 10% pay hike for a CEO-promoter in FY2021, a year of bad...