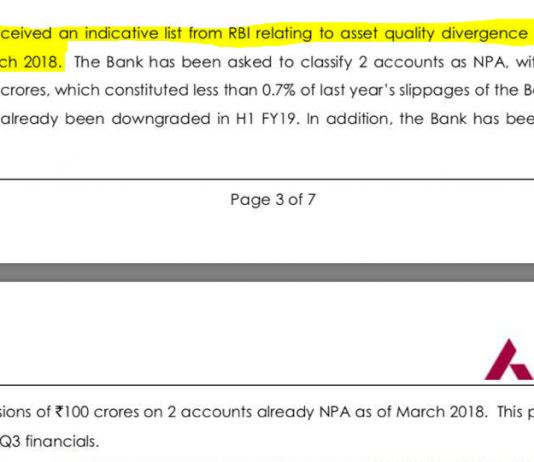

Even in a rowdy game of soccer, two yellow cards result in dismissal from the field of play. Indian banking, though, adheres to lower standards. For two consecutive years, Axis Bank has been exposed by the regulator for mis-reporting in its financial statements; yet the bank’s board of directors...

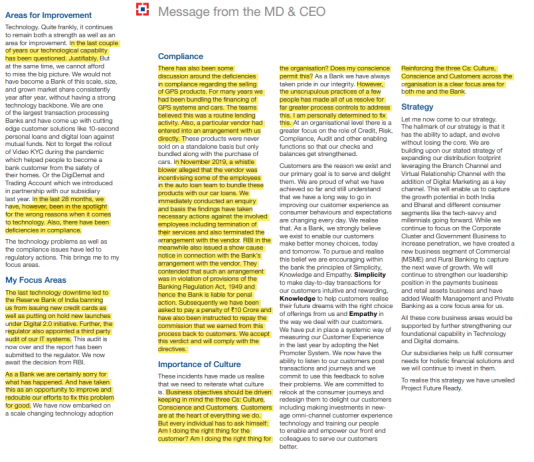

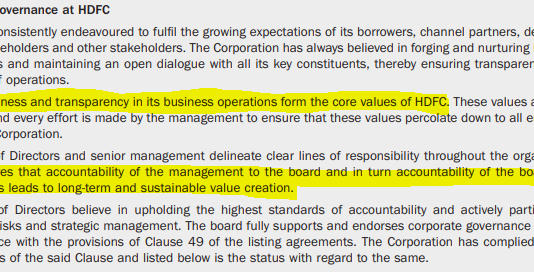

EXECUTIVE SUMMARY. There is a surprising change in the public profiles of the Chief Executive Officers (CEOs) of India’s first and second largest private sector banks, HDFC Bank and ICICI Bank. What are the implications?

Both Sashidhar Jagdishan and Sandeep Bakshi stepped into the shoes of high-profile predecessors: the iconic...

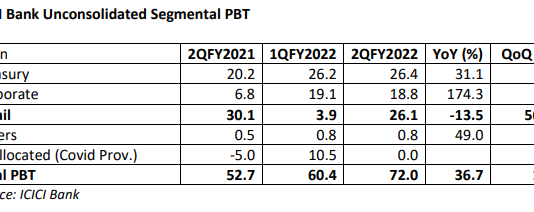

EXECUTIVE SUMMARY. ICICI Bank reported strong profits for 2QFY2022, with standalone net profits increasing by 30% YoY to Rs 55 bn., enthusing the market. The bank has been focusing on retail loans to drive its assets and profits, after heavily haemorrhaging on corporate loans prior to FY2020. The retail...

EXECUTIVE SUMMARY

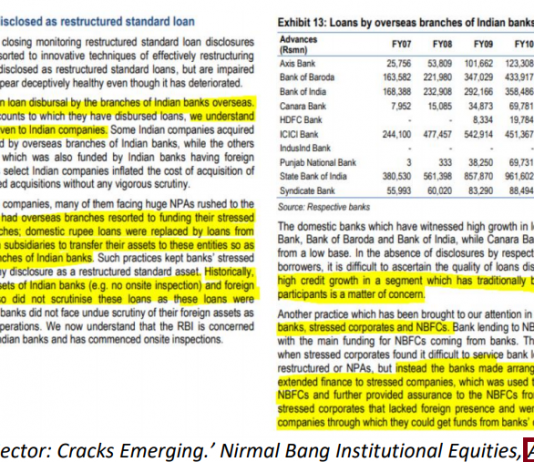

The ‘Interim Report of IL&FS and Its Subsidiaries’ dated November 30, 2018 by the Serious Fraud Investigation Office (SFIO), which was submitted by the Ministry of Corporate Affairs (MCA) to the National Company Law Tribunal (NCLT), not only reveals the shenanigans of IL&FS’s senior management but also puts the spotlight...

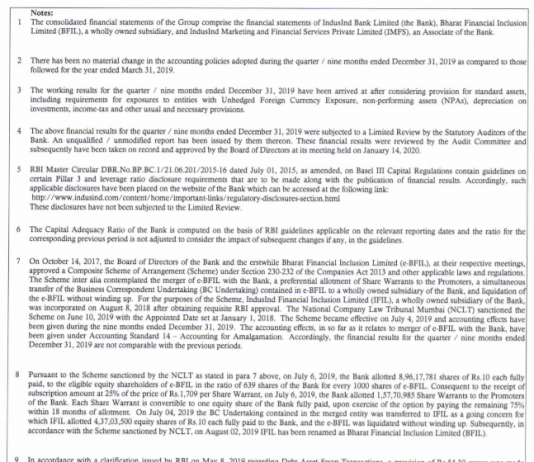

EXECUTIVE SUMMARY. In a stunning non-disclosure, Indusind Bank conveniently neglected to reveal, in its 3QFY2020 results, that it had reduced shareholder funds by around Rs 6.7 bn as a charge for frauds without charging it to profits. The bank reported a consolidated net profit of Rs 13.09 bn...

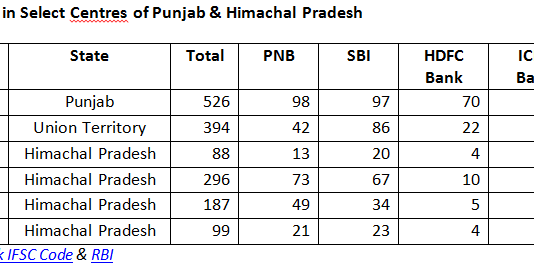

EXECUTIVE SUMMARY. A visit by road to some of the scenic tourist destinations in the mountainous and mainly rural state of Himachal Pradesh highlights the negligible presence of private sector banks and the sheer dominance of government banks, particularly Punjab National Bank and the banking behmoth, State Bank of...

EXECUTIVE SUMMARY. The ET Prime 3-part series based on the Securities and Exchange Board of India’s (SEBI) show cause notices to Standard Chartered Bank, Indusind Bank and Aditya Birla Finance highlighted the manner in which these institutions allegedly ‘evergreened’ their exposure and shifted their loans from the unlisted Thapar...

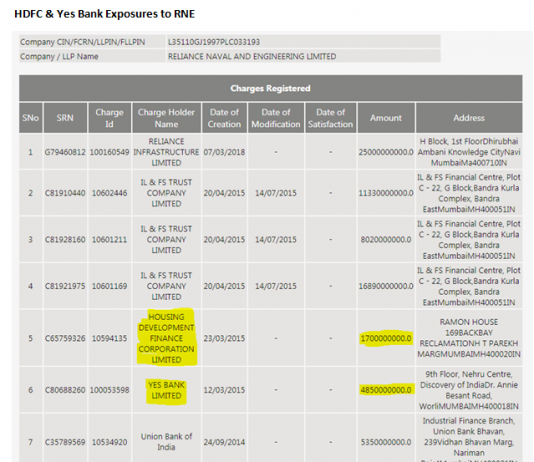

Reliance

Naval Engineering (RNE) will in all likelihood be classified as non-performing

by all the concerned banks in the consortium for the quarter ended March 31,

2018. Long facing difficulty meeting its financial obligations, the company

finally fell short in the December quarter. In the March quarter, banks in the

consortium were unable to...

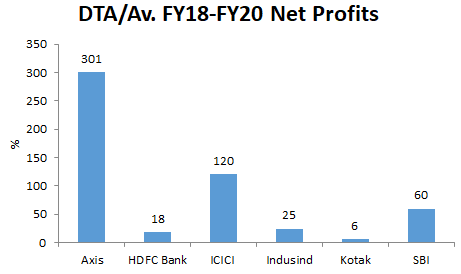

EXECUTIVE SUMMARY. At a time when many private sector banks such as HDFC Bank, ICICI Bank, Axis Bank, Indusind Bank and Yes Bank have increased their deferred tax asset (DTA) in 2HFY2020 as compared with 1HFY2020, thereby inflating their net profits in the period, it is heartening to observe...

EXECUTIVE SUMMARY

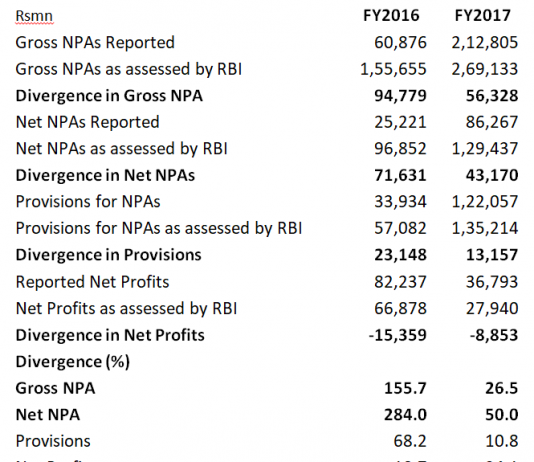

Yes Bank is in the cross hairs of the Reserve Bank of India (RBI), the banking regulator. On February 13, 2019, the bank issued a press release stating that the regulator’s risk assessment report (RAR) for the year ended March 31, 2018 revealed nil divergence, i.e. the bank’s...