In the first 2-3 working days of December, 2019 Asiamoney’s ‘Best Digital Bank’ for 2019 in India failed its digital customers: they were unable to log onto either the bank’s mobile application or its internet banking platform. The problem recurred on December 7. That India’s number 1 bank by...

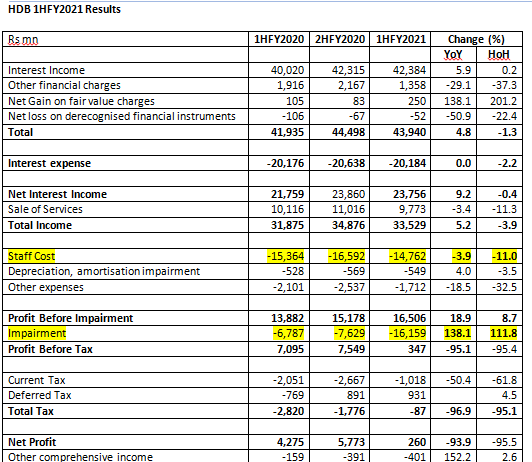

EXECUTIVE SUMMARY. HDFC Bank’s 1HFY2021 results is a study in contrasts to its non-bank finance company (NBFC) subsidiary, HDB Financial Services (HDB). While the standalone bank reported a 19% yoy growth in net profits, HDB’s profits collapsed by an alarming 94% yoy (HDB reports only half-yearly performance). The dichotomy...

The central bank's decision to not spell out a rationale does little in terms of adding to the ownership debate.

Hemindra Hazari BANKING 12 HOURS AGO

It was surely one of the more odd episodes in the history of banking regulation. The Reserve Bank of India (RBI) recently concluded...

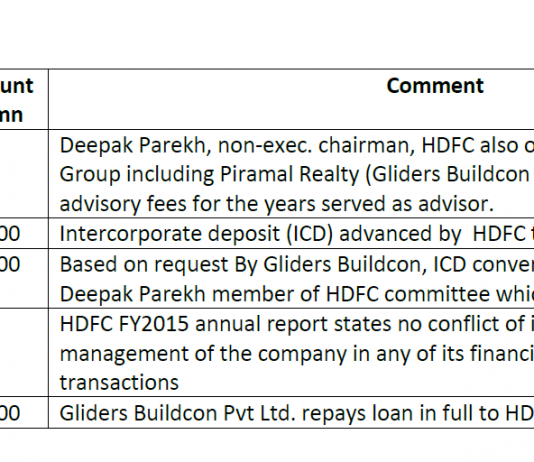

EXECUTIVE SUMMARY. In a significant event, Deepak Parekh, the non-executive chairman of HDFC, agreed to settle with the Securities and Exchange Board of India (SEBI) in connection with the latter’s investigation of non-compliance with the erstwhile Listing Agreement. Parekh settled the issue by paying Rs 937,500 (US$ 12,727) to...

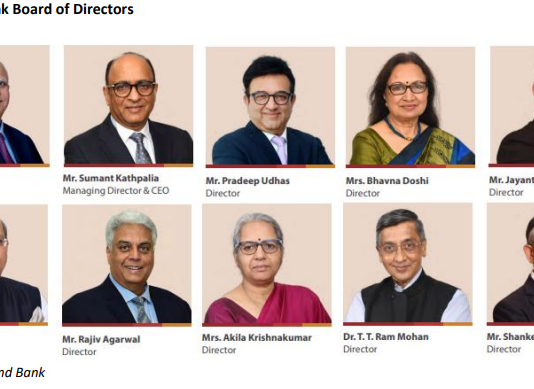

Indusind Bank: When Half the Staff Left, Why Didn’t Independent Directors Think It Worth Mentioning?

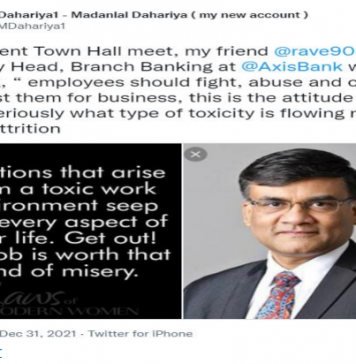

Private sector banks’ high and sharply rising attrition is in the spotlight, thanks to the mandatory disclosures in banks’ annual and business sustainability reports since FY2023. However, inter-bank comparison may not be an accurate indicator of the attrition in a particular bank, as some large banks use unlisted subsidiaries...

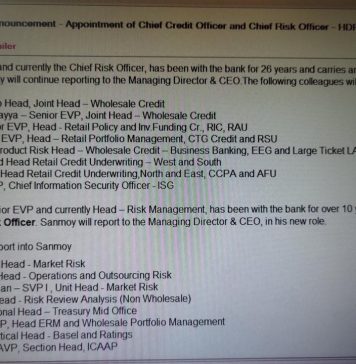

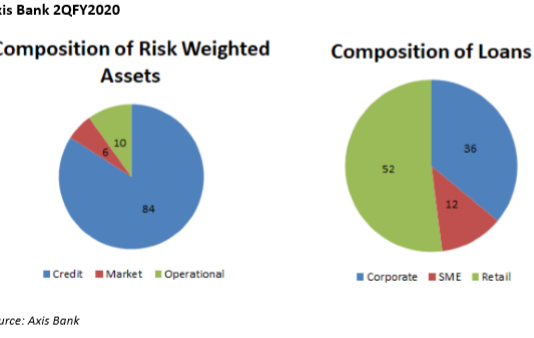

EXECUTIVE SUMMARY. Axis Bank recently diminished the authority of its Chief Risk Officer (CRO) by taking corporate credit risk assessment away from him and giving it to the Chief Credit Officer. Cyril Anand, President and Chief Risk Officer (CRO), Axis Bank, has been ‘retired’ early, and the bank has...

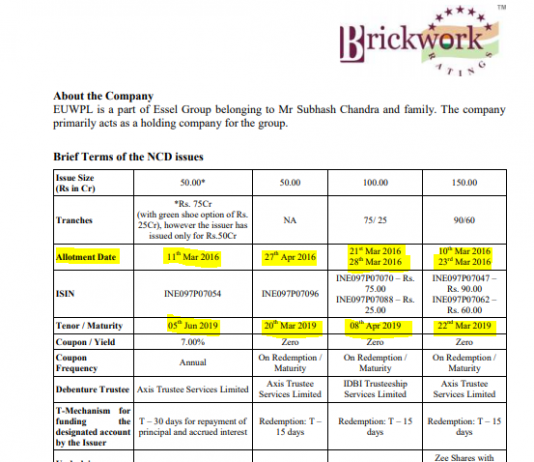

HDFC Asset Management Co. (HDFC AMC), promoted by HDFC is in the news for all the wrong reasons, a rare situation for a blue-blooded group which is the darling of institutional investors. The only saving grace is that it is not the only AMC which has been impacted...

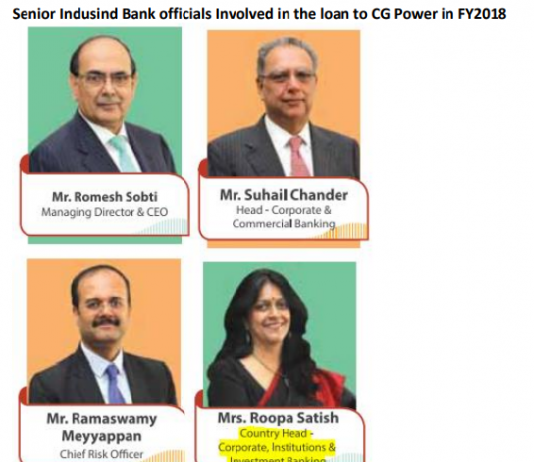

EXECUTIVE SUMMARY. In a major scoop, ET Prime on June 9, 2021 revealed the contents of the Securities and Exchange Board of India (SEBI)’s ongoing investigation into Indusind Bank’s October 2017 US$ 40 mn loan to CG Middle East FZE (CG ME), a step down subsidiary of CG Power...

On the one hand, Kotak Mahindra Bank (KMB) is proudly broadcasting to shareholders its thoughts on the virtues of corporate governance, and how the bank is more than merely conforming to the letter of the law. At the same time, a notice to KMB shareholders seeking approval to re-appoint...

The legal battle concerns the RBI’s instructions to Kotak Mahindra Bank to reduce the promoter holding, and the bank's sharp practices while appearing to comply.

By Hemindra Hazari

MUMBAI, Maharashtra—A royal legal battle has been going on between Kotak Mahindra Bank (KMB) and the banking regulator, the Reserve Bank of India (RBI), in...