EXECUTIVE SUMMARY.

“hush money”: money paid to someone to prevent them from disclosing embarrassing or discreditable information – Concise Oxford English Dictionary

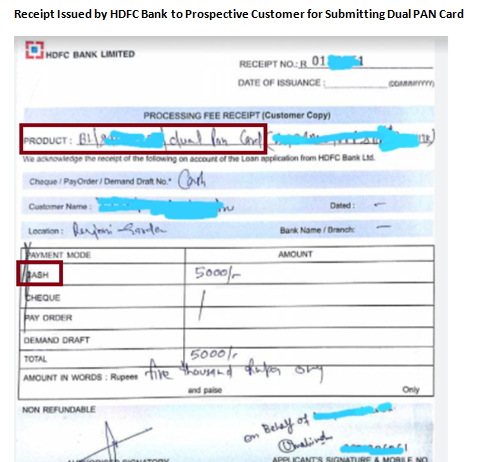

HDFC Bank, India’s...

EXECUTIVE SUMMARY. The IDFC’s board of directors’ decision to reclassify Vinod Rai, hitherto independent director, as a non-independent non-executive director provides a backdoor entry...

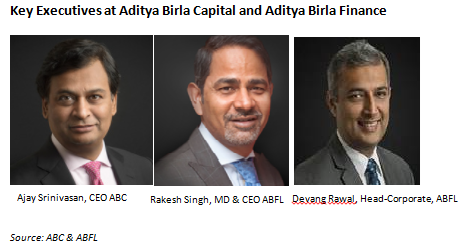

EXECUTIVE SUMMARY. Senior executives are rushing for the exit door at Aditya Birla Finance Ltd. (ABFL), the non-bank finance company (NBFC) subsidiary of Aditya...

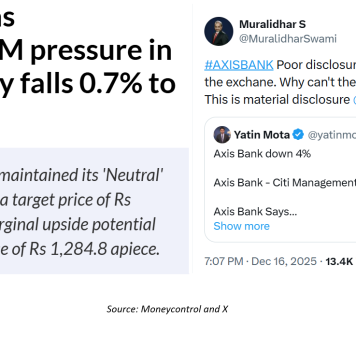

EXECUTIVE SUMMARY. The Securities and Exchange Board of India (SEBI)’s order penalising Kotak Mahindra Mutual Fund (Kotak MF), a subsidiary of Kotak Mahindra Bank...

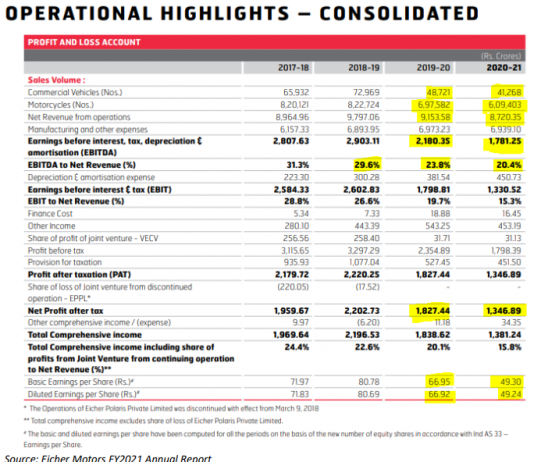

EXECUTIVE SUMMARY. Institutional investors were recently in the news for opposing a 10% pay hike for a CEO-promoter in FY2021, a year of bad...

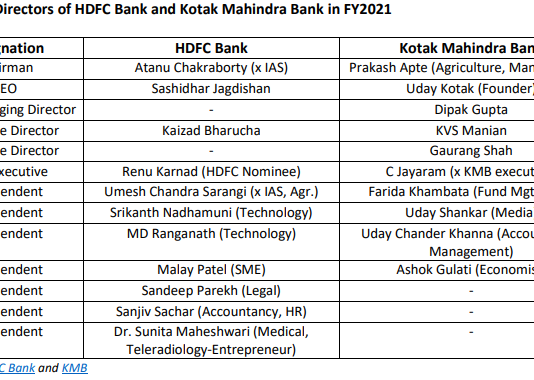

EXECUTIVE SUMMARY. A notable feature in HDFC Bank and Kotak Mahindra Bank (KMB) is the historical absence of any commercial banking expertise amongst the...

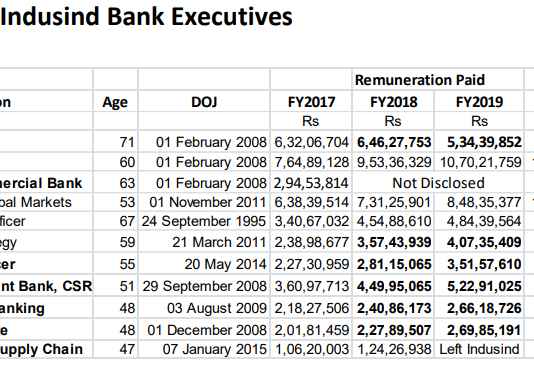

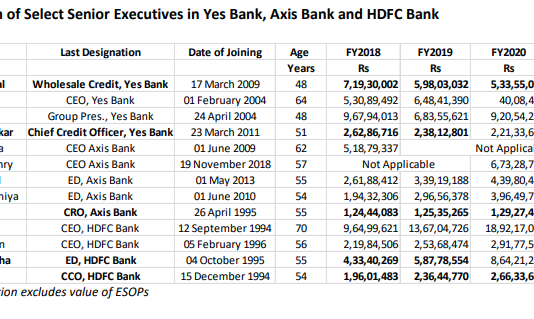

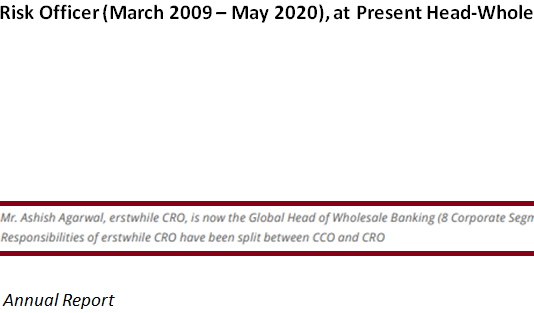

EXECUTIVE SUMMARY. Most private sector banks withhold the remuneration details of senior executives in the annual reports. However, shareholders can specifically request this disclosure...

EXECUTIVE SUMMARY. Pay obscene remuneration to a favoured few, completely out of sync with the already inflated salary structure in the industry, silently watch...

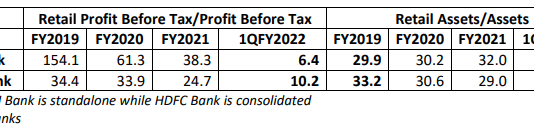

EXECUTIVE SUMMARY. ICICI Bank’s 1QFY2022 results on July 24, 2021 highlight the need for shareholders to re-examine the bank’s retail asset strategy. ICICI Bank’s...

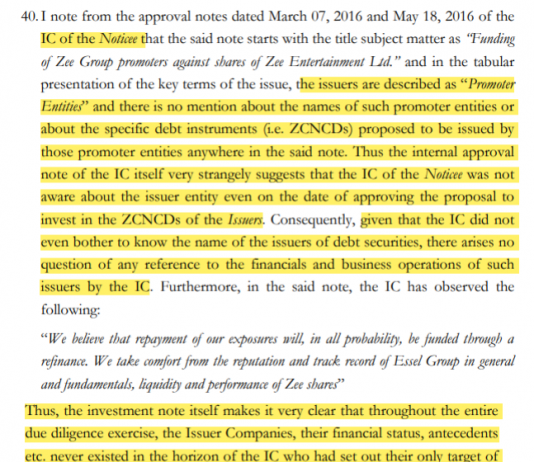

EXECUTIVE SUMMARY. Despites the paeans of self-praise in annual reports, exposé after exposé by the media reveal the abysmal state of corporate governance in...