EXECUTIVE SUMMARY. Why is the capital market deliberately overlooking the serious concerns regarding corporate governance in the Kotak Mahindra group? Presumably because the bank...

Kotak Mahindra Bank (KMB) sent the following response to this analyst’s article, “KMB Talks of “Highest Standards of Corporate Governance”, But Avoids Telling Shareholders...

On the one hand, Kotak Mahindra Bank (KMB) is proudly broadcasting to shareholders its thoughts on the virtues of corporate governance, and how the...

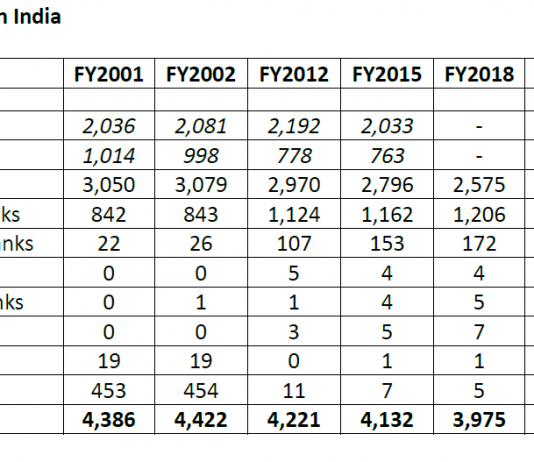

EXECUTIVE SUMMARY. According to the grand theory of capitalism and the free market, competition anoints the customer as king. In the capital market, it...

EXECUTIVE SUMMARY. On July 19, 2022, based on a police press release, the media reported (here and here) a major theft in the currency...

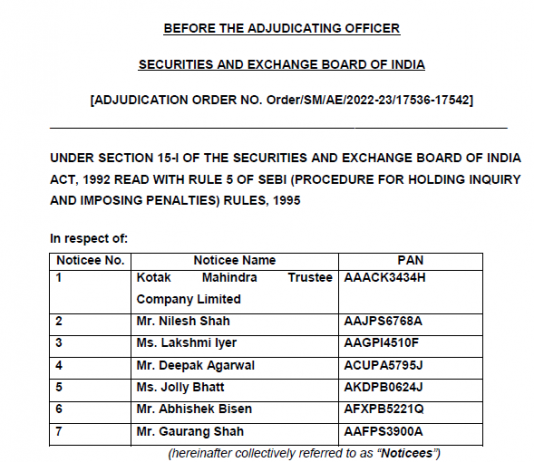

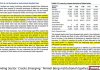

The Securities and Exchange Board of India (SEBI)’s order dated June 30, 2022 indicted not only the senior-most executives of Kotak Mahindra Mutual Fund...

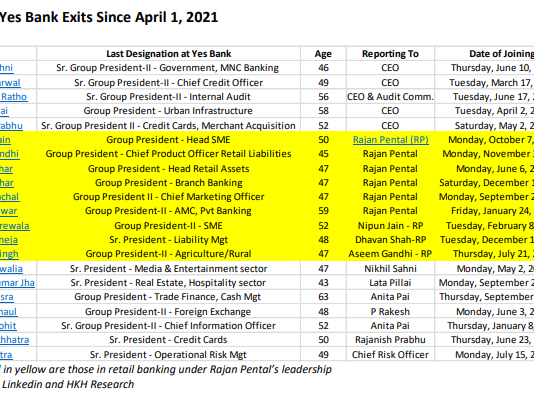

EXECUTIVE SUMMARY. Yes Bank is in the news for its non-performing assets, a legacy of erstwhile founder-CEO Rana Kapoor’s reckless lending being transferred to...

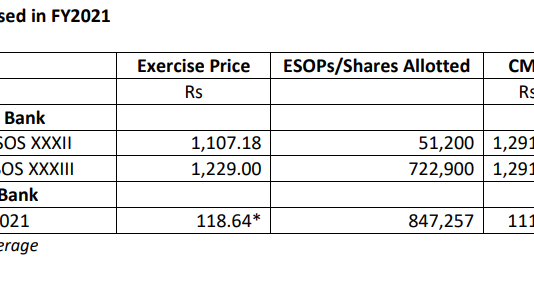

EXECUTIVE SUMMARY. When private bank stocks languish, or worse, spiral downwards, it is not just shareholders whose wealth erodes. Senior management executives, the elites...

EXECUTIVE SUMMARY. The phenomenal success of HDFC Bank under the stewardship of Aditya Puri, its first CEO, had some unfortunate consequences. It led to...

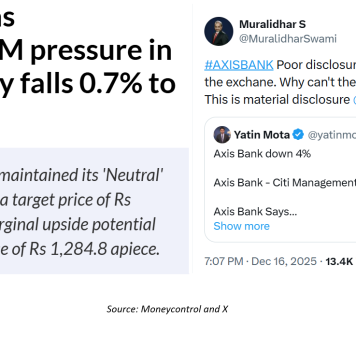

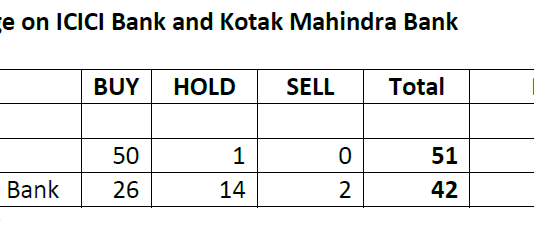

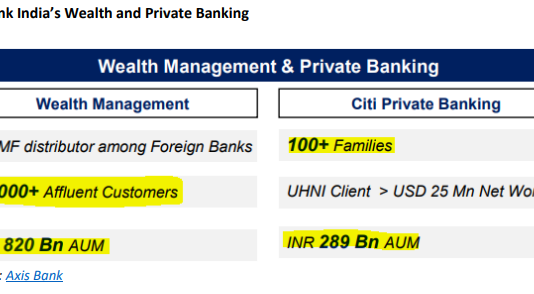

EXECUTIVE SUMMARY. Axis Bank’s acquisition of Citibank India’s consumer finance division has been applauded by the stock market, and the bank has outperformed Nifty-50...